Total Annual Income Tax Calculator

This determines your applicable tax slab rates. The result in the fourth field will be your gross annual income.

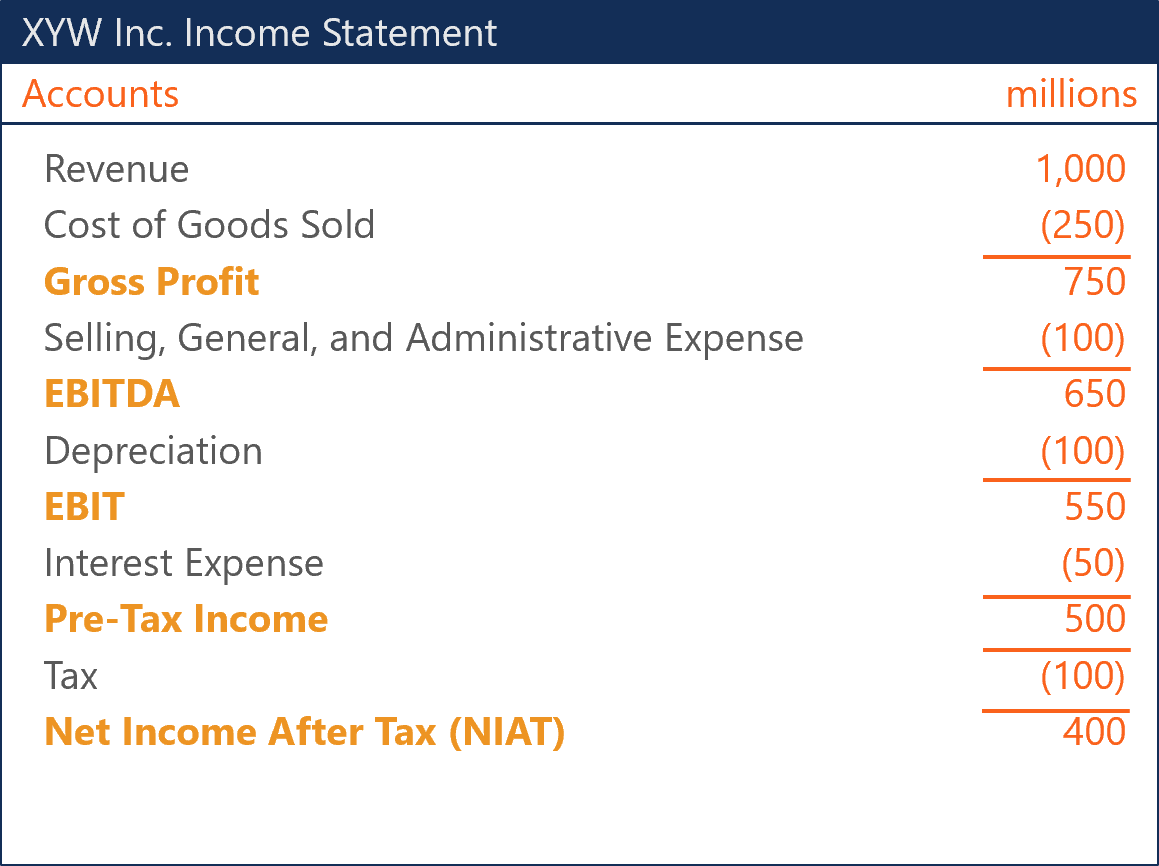

Net Income After Tax Niat Overview How To Calculate Analysis

You can read more about it in the gross to net calculator.

Total annual income tax calculator. Use this calculator to work out your basic yearly tax for any year from 2011 to 2021. The calculator will return your equivalent annual salary. It also will not include any tax youve already paid through your salary or wages or.

Are calculated based on tax rates that range from 10 to 37. In the 2021-22 tax year that personal allowance will rise to 12570. The adjusted annual salary can be calculated as.

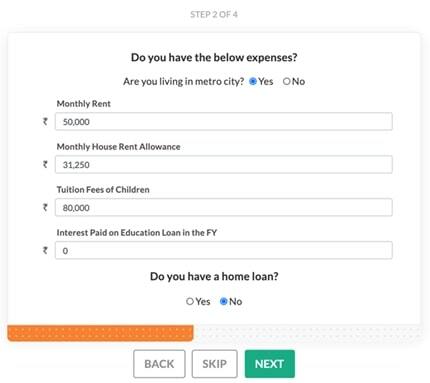

Net Annual Value 1-23 Less. It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC. The steps to use the tool are as given below - Choose your age bracket.

Here a disclosure of the existing investments has to be done. To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator. Income taxes in the US.

We have updated our income tax calculator according to the latest income tax rates rules so you may calculate your tax with accuracy and without worry. The annual income tax on 139723 is Round your answer to the nearest penny The overall percent of the annual income that is paid to taxes is Round your answer to the nearest tenth of a percent Use the following table to calculate the income tax. Simple tax calculator This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

For an individual or business with multiple income streams or sources of earnings their total annual income will be equal to the sum of all the income sources. The calculator is updated for the UK 2021 tax year which covers the 1 st April 2021 to the 31 st March 2022. Short Term Capital GainS Other than covered under section 111A From.

Taxable Income Monthly Salary - Total Deductions 25000 - 1600 23400 Base on our sample computation if you are earning 25000month your taxable income would be 23400. On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

All bi-weekly semi-monthly monthly and quarterly figures. Income Tax Calculator An income tax calculator is a simple online tool which can help you calculate taxes payable on your income. Total Tax Annual Income x 010 95250 Annual Income -9525 x 012 4 45350 Annual Income - 38700 X 5022 1408950 Annual.

Income Tax Department Income and Tax Calculator Income Tax Department Tax Tools Income and Tax Calculator. Here one needs to select whether they are residing in a Metro City or not. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more.

For example Sarah works part-time at Online Co earning 32000 per year and also works part-time at Offline Co earning 21000 per year. Standard Deduction 30 of Net Annual Value ii. The Canada Annual Tax Calculator is updated for the 202122 tax year.

You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables. Federal income tax rates range from 10 up to a top marginal rate of 37. Interest on Housing Loan Income from Let-out House Property Capital Gains Show Details.

What is her total annual income. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits. Median household income in 2019 was 65712.

The income tax calculator is an easy to use online tool which provides you an estimation of the taxable income and tax payable once you provide the necessary details. How Your Paycheck Works. Annual Income Calculator Enter your hourly rate days per week worked of weeks worked per year and hours per day into the annual income calculator.

A financial advisor can help you understand how taxes fit into your overall financial goals. It can be used for the 201314 to 202021 income years. States impose their own income tax for tax year 2020.

Deductions from Net Annual Value i. Individuals falling under the taxable income bracket are liable to pay a specific portion of their net annual income as tax. How to use Scripboxs income tax calculator.

The first four fields serve as a gross annual income calculator. An Income-tax calculator is an online tool that helps to evaluate taxes based on a persons income once the Union Budget for the year is announced. Subtract your total deductions to your monthly salary the result will be your taxable income.

Between 50271 and 150000 youll pay at 40 known as the higher rate and.

80 000 After Tax 2021 Income Tax Uk

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Salary Formula Calculate Salary Calculator Excel Template

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

What You Need To Know About Income Tax Calculation In Malaysia

How To Calculate Income Tax In Excel

How To Calculate Income Tax Slab Rate For Individuals Basics Of Inco

Taxable Income Formula Calculator Examples With Excel Template

Annual Income Learn How To Calculate Total Annual Income

Excel Formula Income Tax Bracket Calculation Exceljet

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Income Tax Formula Excel University

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Post a Comment for "Total Annual Income Tax Calculator"