Total Annual Gross Income Meaning

Gross total income refers to the total of income computed under the five heads of income. For companies gross income is interchangeable with gross margin or.

Operating Income Vs Gross Profit

Want to learn more.

Total annual gross income meaning. The annual turnover clearly indicates the market strength of a company and the image of such a company among the customers. Q - Is a surcharge calculated on total income or on taxable income. Your total income is your gross income from all sources less certain deductions such as expenses allowances and reliefs.

To determine gross monthly income divide the. It is an indicator of an entitys earning strength. Gross income refers to the total amount earned before taxes and other deductions just like annual salary.

Gross Total Income is the total income earned by the individual including income from all the heads. Her gross annual income was 50000. Want to learn more.

It takes into consideration total earnings purely based on the quoted selling price and a number of products sold. Her gross annual income was 50000. Taxable income starts with gross income then certain allowable deductions are.

The total amount of a persons or organizations income in a one-year period before tax is paid on it. Surcharge is neither calculated on total income nor on taxable income. Section 80B5 of the IT Act defines Gross Total Income.

The total amount of a persons or organizations income in a one-year period before tax is paid on it. Subject to the following rewordingtotal gross income covers the total monetary and non-monetary income received by the household over a specific income reference period. There are five heads of income such as income from property income from salary income from other sources income from business or profession and lastly income from capital gains.

Your gross income is the total amount of money you receive annually from your monthly gross pay. The gross total income GTI is the total income you earn by adding all heads of income. Annual income is the total value of income earned during a fiscal year Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual.

D is the number of days worked per week. Includes income received or receivable by you in the previous year adjusted for clubbing and carry-forward amounts from previous years. If you are married or in a civil partnership and jointly assessed your spouses or civil partners income is included in total income.

Annual revenue is the total amount of money a company makes during a given 12-month period from the sale of products services assets or capital. Gross annual income is the amount of money that a person earns in one year before taxes and includes income from all sources. Where BO is bonuses or overtime.

Taxable income is obtained after deducting various deductions under chapter VI A from gross total income. Income from salary property other sources business or profession and capital gains earned in a financial year are all added to arrive at the GTI. W is the number of weeks worked per year.

Improve your vocabulary with English Vocabulary in Use from Cambridge. The reason your gross pay is always higher than your net pay is due to some mandatory and voluntary deductions from your employer and potentially due to choices you have made about savings or benefits. What is total income.

De très nombreux exemples de phrases traduites contenant total gross annual income Dictionnaire français-anglais et moteur de recherche de traductions françaises. Deduct the non-taxable parts of your income from this amount to estimate Gross Total Income. Improve your vocabulary with English Vocabulary in Use from Cambridge.

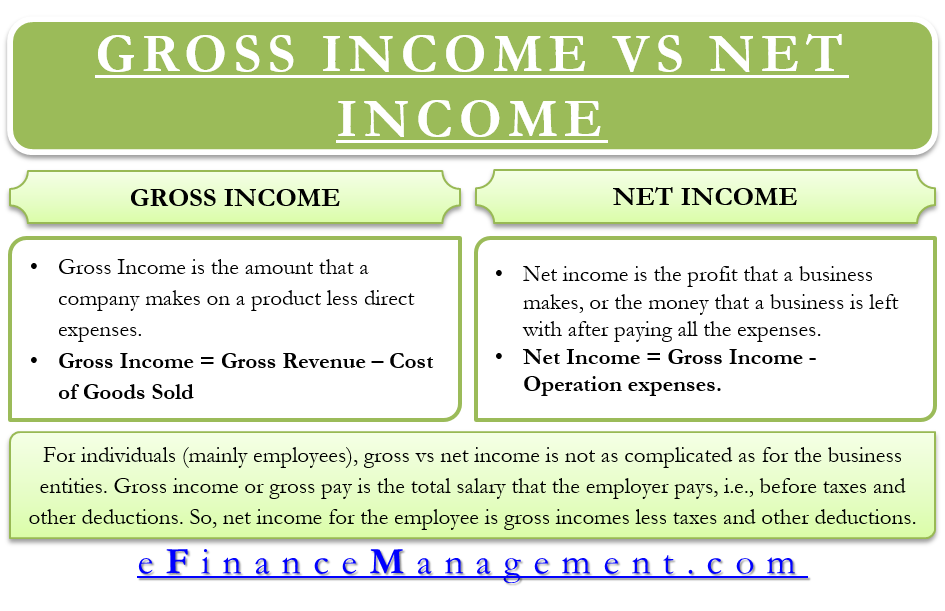

Gross annual income refers to all earnings Earnings Before Tax EBT Earnings before tax or pre-tax income is the last subtotal found in the income statement before the net income line item. Gross income is all income from all sources that isnt specifically tax-exempt under the Internal Revenue Code. Your gross annual income and gross monthly income will always be larger than your net income.

Annual Salary PDHWBO. Where P is your hourly pay rate. Annual revenue does not account for.

Annual income is defined as the annual salary before taxes an individual earns on a yearly basis. H is the number of hours worked per day.

The Difference Between Gross And Net Pay Economics Help

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Gross Vs Net Learn The Difference Between Gross Vs Net

Gross Total Income Difference Between Gross Total Income And Total Income Tax2win

Gross Income Formula Step By Step Calculations

Annual Income Learn How To Calculate Total Annual Income

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Annual Income Calculator

What Is Gross Income For A Business

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Profit Margin Vs Net Profit Margin Formula

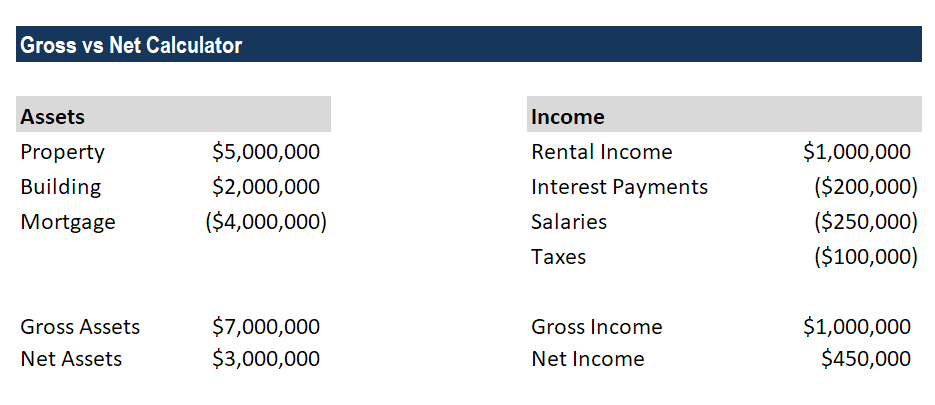

Difference Between Gross Income Vs Net Income Definitions Importance

How Do Earnings And Revenue Differ

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Base Salary Definition And Ways To Determine It Snov Io

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Gross Income Definition Formula Examples

Post a Comment for "Total Annual Gross Income Meaning"