13th Month Pay And Other Benefits Are Part Of The Gross Income For Income Tax Purposes

Thirteenth 13th Month Pay Year-End Bonus and Other Benefits not exceeding Ninety Thousand Pesos P9000000 paid or. 13th Month Pay Vs.

Dole Guidelines For 13th Month Pay In Private Sectors

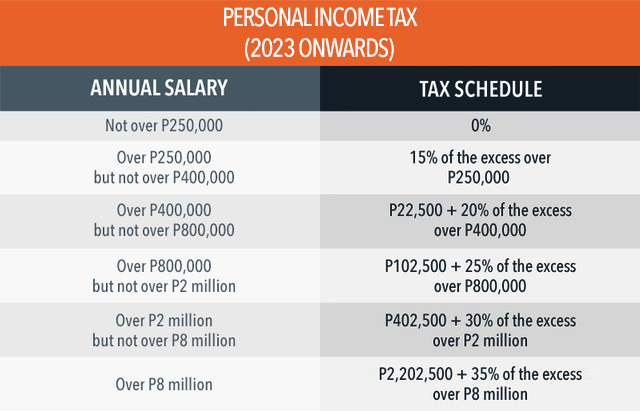

Under the TRAIN Law 1 the 13th-month pay and other benefits received by an employee not exceeding Php 90000 are excluded from the computation of gross income and thus exempt from taxation.

13th month pay and other benefits are part of the gross income for income tax purposes. 851 which requires employers to grant 13 th month pay to all its rank and file employees. Currently the annual limit for 13th month pay and other benefits is pegged at 30000 PHP. Employees who have resigned or have been severed from the company before the payment of the 13th month pay are still entitled to it in proportion to the length of time they worked for during that year.

This new amount is a relative increase from the previous tax exclusion rate of P82000. Hence if you receive a 13th-month pay amounting to more than Php 90000 the excess of said amount is included in your gross income and shall be taxable. Compensation income includes all remunerations received under an employer employee relationship including all fringe benefits of managerial or supervisory employees.

13th-month pay and other Other Benefits - 13th-month and bonuses given to employees 38. 13th month pay and other benefits are taxable only up to P90000. E 13th Month Pay and Other Benefits.

13th-month payalso sometimes referred to as the 13th-month bonus 13th-month salary or thirteenth salaryis a monetary benefit that is either mandatory by law or customary for the countries that participate. Benefits of veterans of war or retired US army personnel are excluded in gross income. The amount included in the list of the de minimis shall not be considered as part of the P82000 ceiling of the 13th month pay bonuses and other benefits that are excluded from gross income in the computation of the taxable income.

The Situs of taxation has an impact on the extent of the reportable gross income. The amendment stipulates that the 13th month pay and other equivalent benefits shall not be subject to tax for a maximum of P90000. The revised guideline says that The basic salary of an employee for the purpose of computing the 13th month pay shall include all remunerations or earning paid by.

In other words if other benefits and the 13 th month pay combine to a total of less than PHP 90000 US1778 no tax is to be paid. That was until the Upper and Lower House came into an agreement. Hazard Pay MWE - hazard payment is given to employees for performing hazardous duties if applicable 37.

12 non-taxable compensation income of government employees that every accountant should know to avoid committing errors in the computation of their income tax 1. De Minimis Benefits - small values provided by the employer to employees merely as a means to promote health good will contentment or efficiency. 13th-month pay and other benefits eg Christmas bonus performance-based incentives etc worth Php 90000 and below De minimis benefits eg paid vacation leave medicalmealclothing allowance rice subsidy Christmas gifts and achievement awards given to employees etc not exceeding the prescribed maximum amount.

One of the original suggestions on how to tax 13th-month pay and other forms of bonuses was to scrape the exception altogether and just include it as the part of a P250000 income tax exemption. If you have above 30K then surely its taxable. The portion thereof in excess of PHP90000 forms part of taxable compensation.

It is a mandatory benefit provided to employees pursuant to Presidential Decree No. Provided however That the total exclusion under this subparagraph shall not exceed Thirty thousand pesos P30000 which shall cover. Compensation income includes regular compensation supplemental compensation and 13th month pay and other benefits in excess of P90000.

By law this benefit must be paid before December 24th and is mandatory. The reportable gross income from business or the exercise of a profession is net of cost of goods sold or services. - Gross benefits received by officials and employees of public and private entities.

Each year a 13th month pay is given to all rank-and-file employees. Any company that hires employees internationally is required to comply with the host countrys employment and compensation laws and labor rights. 13th-month pay and other benefits such as productivity incentives and Christmas bonus up to ninety thousand pesos PHP90000 are considered an exclusion from gross income.

That is if you aggregate your monthly benefits given by your employer in one year and add your 13th month pay and the sum is 30K or less you are lucky enough to take it all home free from taxes. However the same en toto may be considered part of the term Other Benefits in Section 32 B 7 e of the Philippine Tax Code as amended which is excludible from the employees gross income so long as the same in addition to the 13th month pay and other benefits received does not. Bonus is an amount granted to an employee in excess of what the law requires as a reward or incentive for achieving a goal andor contributing to the success of the employers business.

If the combination of other benefits and the 13 th month pay exceeds the limit the excess will be subject to income tax.

13th Month Pay An Employer S Guide To Monetary Benefits

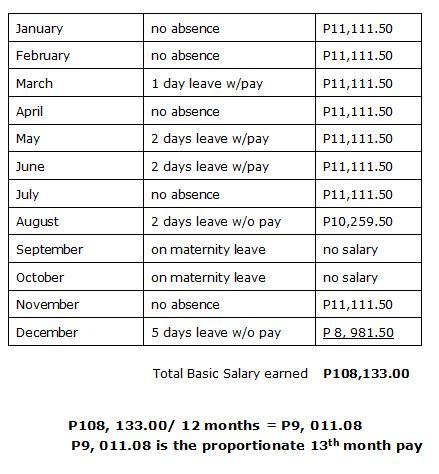

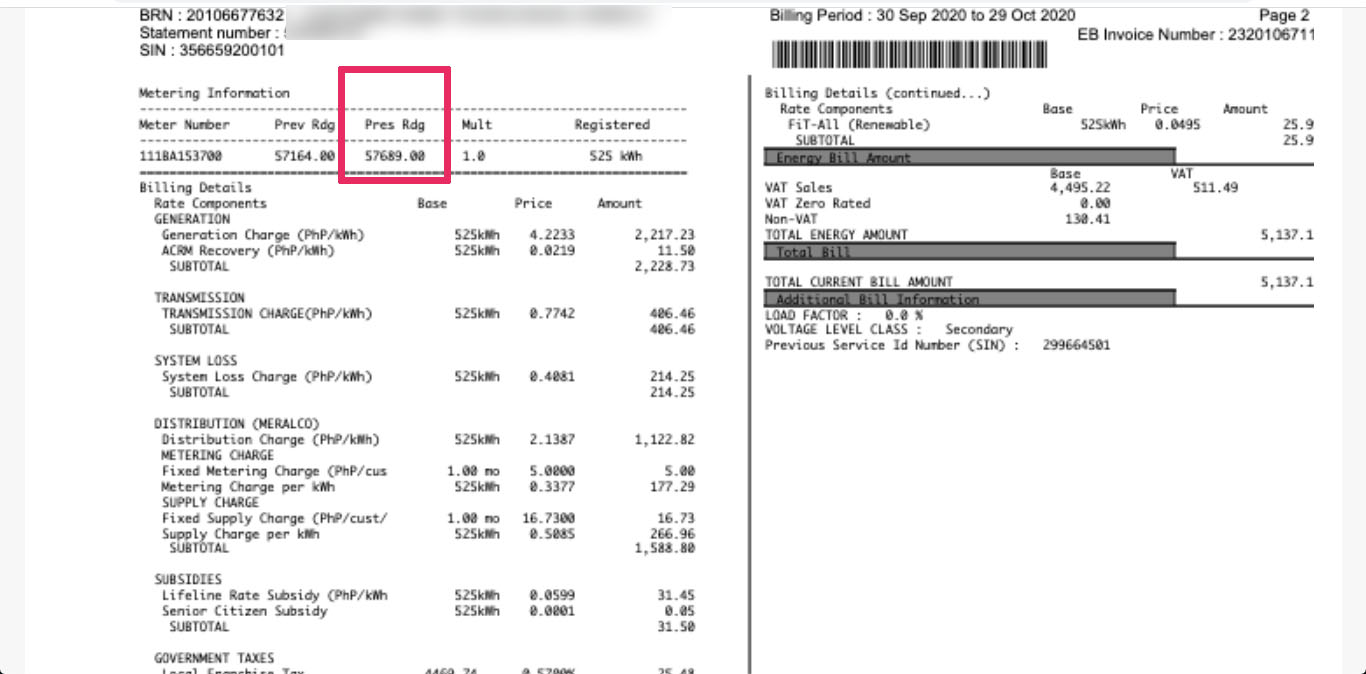

How To Compute Your 13th Month Pay Income Tax Meralco Bill Other Bayarin Pep Ph

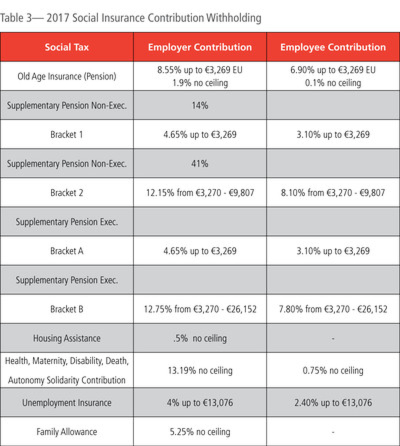

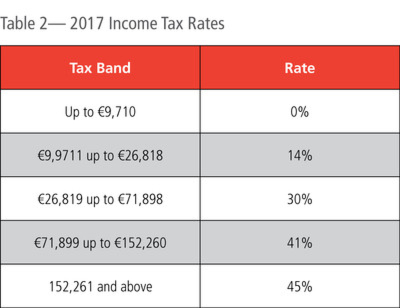

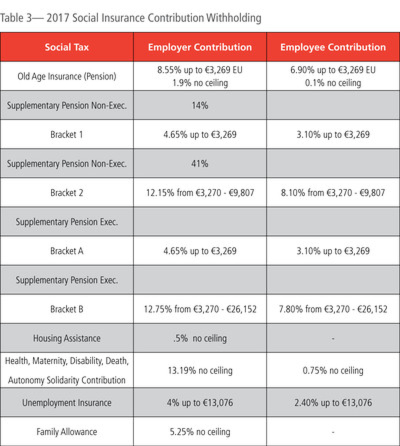

Country Spotlight What To Know About Payroll In France

13th Month Pay An Employer S Guide To Monetary Benefits

Https M5 Paperblog Com I 106 1064677 13th Month Pay L Wlwizk Jpeg

How To Compute Your 13th Month Pay Income Tax Meralco Bill Other Bayarin Pep Ph

Increase In The Ceiling Of 13th Month Pay And Other Benefits Memoentry

13th Month Pay Law Employee Benefits Piece Work

Tax Calculator Compute Your New Income Tax

Country Spotlight What To Know About Payroll In France

A 13th Month Pay Guide For Employees

Philippines Understanding Taxation Of 13th Month Pay And Christmas Bonuses In The Philippines Asean Economic Community Strategy Center

Dole Guidelines For 13th Month Pay In Private Sectors

13th Month Pay In The Philippines Obligations For Employers Cloudcfo

13th Month Pay An Employer S Guide To Monetary Benefits

Country Spotlight What To Know About Payroll In France

13th Month Pay An Employer S Guide To Monetary Benefits

A Quick Guide To 13th Month Pay 13th Month Pay Months Payroll Software

How To Compute 13th Month Pay In The Philippines An Ultimate Guide

Post a Comment for "13th Month Pay And Other Benefits Are Part Of The Gross Income For Income Tax Purposes"