13th Month Pay Non Taxable

This is computed pro-rata according to the number of months within a year that an employee has worked with an employer. Deduct the tax-exempt Php 90000 from Php 100000.

Philippines Understanding Taxation Of 13th Month Pay And Christmas Bonuses In The Philippines Asean Economic Community Strategy Center

13th month pay is an extra payment made to employees in the Philippines in December.

13th month pay non taxable. However there is a limit as to the maximum amount of the 13th month pay which is exempt from tax. 8424 the benefit must not exceed P30000. Hence if you receive a 13th-month pay amounting to more than Php 90000 the excess of said amount is included in your gross income and shall be taxable.

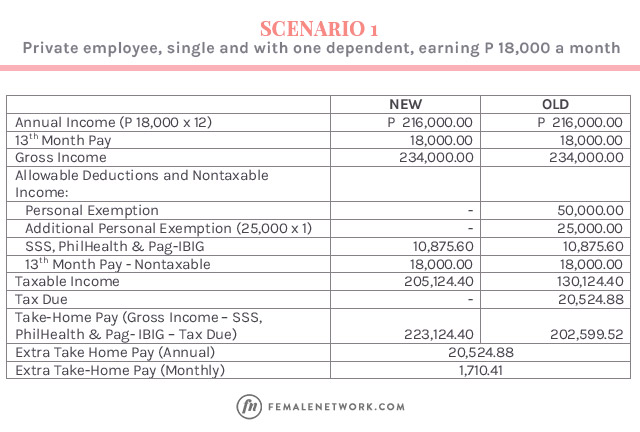

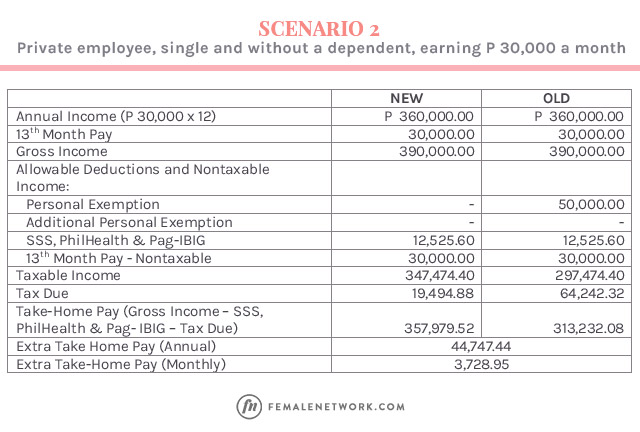

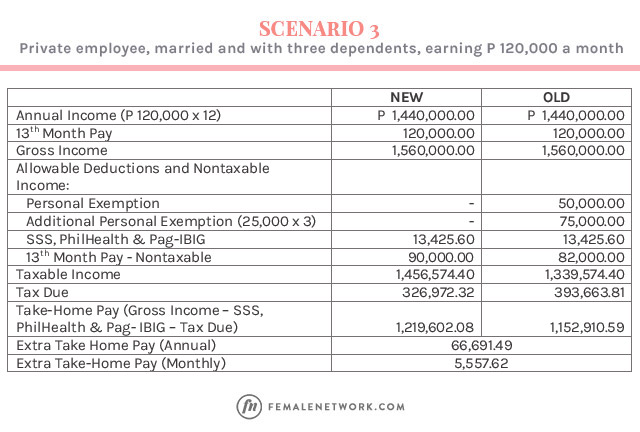

The 13th month pay is generally exempt from taxation. Get the annual salary. Otherwise it is taxed.

10963 or the TRAIN law on January 2018. However employers of the mentioned exempted employees may still opt to give away 13th-month pay voluntarily. This one is partly true and partly not.

The law is also referred to as Presidential Decree No. 10963 or the TRAIN law on January 2018. Employee with a gross monthly salary of Php 100000 and receiving 13th-month pay of the same amount.

Tamang sagot sa tanong. The 13th month pay began as a law in the Philippines in 1975 when the minimum wage had not been updated in the previous 5 years. Php 100000 Php 90000 Php 10000.

13th-month pay is non-taxable. A feature of the 13th Month Pay benefit is its non-inclusion in the computation of an employees regular wage. TaxAcctgCenter - Nov 11 2012 Log in to Reply 0.

Hi Len 13th month pay and other benefits to the extent of P30000 is non-taxable. Courtesy of the TRAIN Law this amount is relatively higher as compared to. The amount of tax-free 13th month pay has been raised to P90000 while the excise tax tiers on sugar-sweetened beverages have been reduced in.

The benefit is non-taxable if. Read the previous discussion. The DOF is seeking the repeal of provisions of the Tax Code that exempt from income tax the 13th-month pay Christmas bonus productivity incentives and.

It is separate from any other bonus given by the company. Under Section 32B Chapter VI of R. However there is a prescribed limit to this exemption provided under Section 32 B7e of the National Internal Revenue Code NIRC which was amended by Republic Act No.

4 lignes 82K is the maximum amount that is non taxable meaning if you receive a total 13th mo bonus. President Marcos put it in place to compensate for the low minimum wage rates considering Congress had. Php 100000 x 12 months Php 1200000.

13th month pay is taxable if it exceeds PHP 90000. Is 13th month pay taxable. Any amount in excess thereof may be subjected to tax.

From the foregoing it can be said that the 13th month pay of employees is not taxable. The payment of 13th month pay is mandated by law. Yes it is not taxable provided that the sum received is less than Php 8200000.

The benefit consists of additional pay based on total basic salary earned during the year divided by 12 months or number of months in the service in case of employees who have exited. More than that is subject to tax at 5-32 tax table. No as long as the amount does not exceed P30000.

The 13 th month pay is given to rank-and-file employees. Since the 13th-month pay is higher than the tax-exempt Php 90000 the excess of that amount is taxable. The 13th-month pay law was originally created in December of 1975 by Philippine President Ferdinand Marcos.

The amendment stipulates that the 13th month pay and other equivalent benefits shall not be subject to tax for a maximum of. Is 13th month pay taxable. Only the amount in excess of P30000 is taxable.

Under the TRAIN Law 1 the 13th-month pay and other benefits received by an employee not exceeding Php 90000 are excluded from the computation of gross income and thus exempt from taxation. The amendment stipulates that the 13th month pay and other equivalent benefits shall not be subject to tax for a maximum of P90000. Is 13th month pay taxable or non taxable.

This new amount is a relative increase from the previous tax. However there is a prescribed limit to this exemption provided under Section 32 B7e of the National Internal Revenue Code NIRC which was amended by Republic Act No. This means that the 13th Month Pay should not be credited as part of the employees regular wage when determining overtime premium pay fringe benefits premium contributions to the State Insurance Fund Social Security System SSS National Health Insurance.

The 13th month pay is generally exempt from taxation. The 13th month pay is equivalent to 112 of the basic salary of an employee within a calendar year.

13th Month Pay An Employer S Guide To Monetary Benefits

13th Month Pay An Employer S Guide To Monetary Benefits

Everything You Need To Know About 13th Month Pay Sunstar

How To Compute 13th Month Pay In The Philippines An Ultimate Guide

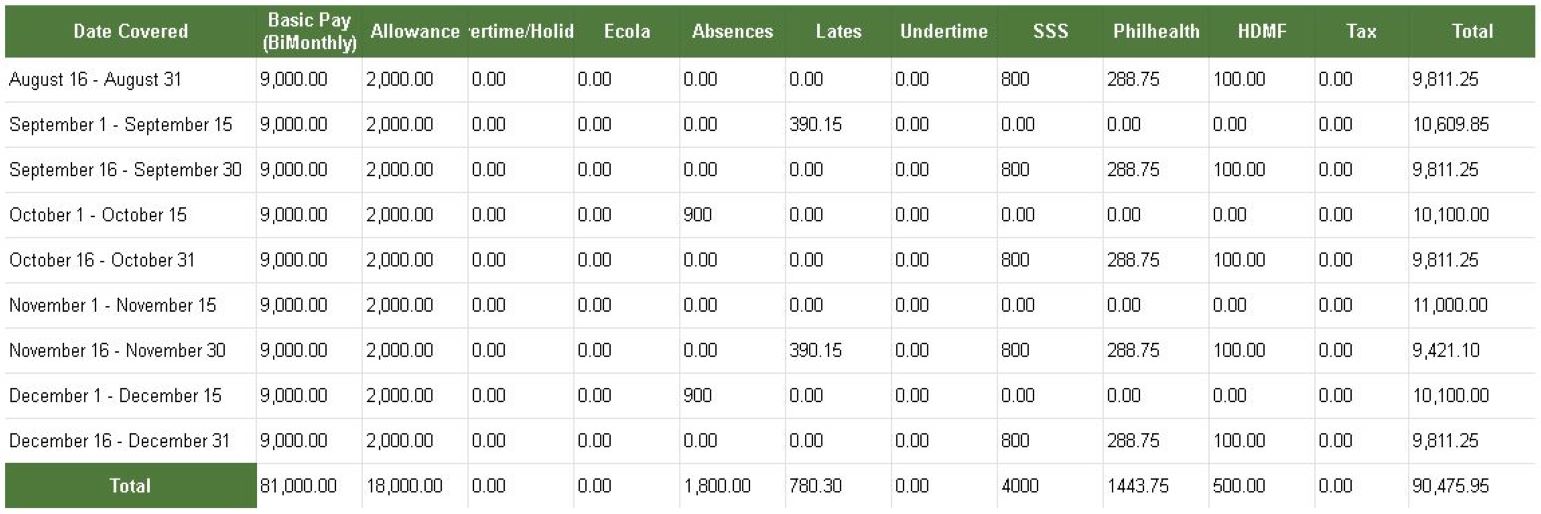

Compute How Much Taxes Will Be Deducted Monthly Under The Train Law

Philippines Understanding Taxation Of 13th Month Pay And Christmas Bonuses In The Philippines Asean Economic Community Strategy Center

How To Compute Your 13th Month Pay 2020 Jobs360

10 Things You Should Know About 13th Month

Compute How Much Taxes Will Be Deducted Monthly Under The Train Law

A Quick Guide To 13th Month Pay 13th Month Pay Months Payroll Software

13th Month Pay An Employer S Guide To Monetary Benefits

Compute How Much Taxes Will Be Deducted Monthly Under The Train Law

A 13th Month Pay Guide For Employees

Dole Guidelines For 13th Month Pay In Private Sectors

Dole Guidelines For 13th Month Pay In Private Sectors

Tax Exemptions And De Minimis Benefits

How To Compute Your 13th Month Pay 2020 Jobs360

13th Month Pay An Employer S Guide To Monetary Benefits

13th Month Pay In The Philippines Obligations For Employers Cloudcfo

Post a Comment for "13th Month Pay Non Taxable"