Basic Salary Limit For Pf

Basic pay is limited to 40 or a max of 50 of total CTC. The statutory compliance for PF contribution has some less known facts associated with it.

Employees Provident Fund Or Epf Rules For Employer

So you can reduce.

Basic salary limit for pf. You will have to pay a minimum PF of Rs. Once it is made reality the EPF wage ceiling move could inflate the governments annual Employees Pension Scheme EPS outflow by 50 to Rs 3000 crore said a report by Financial Express. Can employee pay PF for a.

For the PF deduction the maximum limit of salary of the employee is Rs 15000 per month. This gives an advantage to employees while claiming HRA exemptions. This means that even if the employees salary is above Rs 15000 the employer is liable to contribute only on Rs 15000 that is Rs 1800.

PF is to be deducted at 12 of basic salary plus dearness allowance. As per New Notification issued by EPFO Supreme court ruling Employer can cap PF contribution limit to Rs 6500 Basic Salary. 15 As per provision of Employee Provident Fund Act 12 PF has to be deducted from basic salary.

Contribution to be paid on up to maximum wage ceiling of 15000- even if PF is paid on higher wages. Wge limit under EPF act to cover an employee is Rs6500 per monthAny employee drawing wages more than above will be termed as excluded employee provided he is not already a member of PFif he is already a member of PF then his PF deduction will be on 6500only. The government is set to raise the monthly wage ceiling for mandatory Employees Provident Fund EPF cover to Rs 21000 from Rs 15000 at.

It is directly deposited in the employees PF. 15 You will have to pay a minimum PF of Rs. Cost To Company - CTC.

However you have the option to limit this deduction upto Rs. From 1st September 2014 the EPFO has revised the basic wage limit on which PF contribution will be done from Rs6500 to Rs15000. On May 27 2014 the Employee Provident Fund Office issued a circular permitting Companies to limit its PF contributions against the required salary ceiling limit of INR 6500 per month.

So if your monthly Basic Salary is Rs nearly 175 lakh just the basic salary and not your total monthly income your monthly contribution is nearly Rs 20833 which is Rs 25 lakh in a year. He explains that generally employees having basic salary up to approximately Rs. Basic salary 15000 per month 12 of the basic salary.

Then retirement body - Employees Provident Fund Organisation EPFO had also proposed a wage limit up to Rs 25000 per month for coverage under social security schemes. Basic salary 15000 per month In this case the company has an option to either contribute 12 of 15000 ie. For Pf If Basic Salary is more than 15000 then PF will be restricted upto 1800.

EDLI contribution to be paid even if member has crossed 58 years age and pension contribution is not payable. Also those who contribute additional in VPF and their total contribution exceeds Rs 25 lakh the interest earnings would also get taxed. Believing that your basic salary is more than Rs.

175 lakh per month would not attract tax on their interest earnings on PF. 15 as your basic salary. Each contribution is to be rounded to nearest rupee.

15000 as your basic salary. And also raising their PF contribution above the ceiling limit. As per provision of Employee Provident Fund Act 12 PF has to be deducted from basic salary.

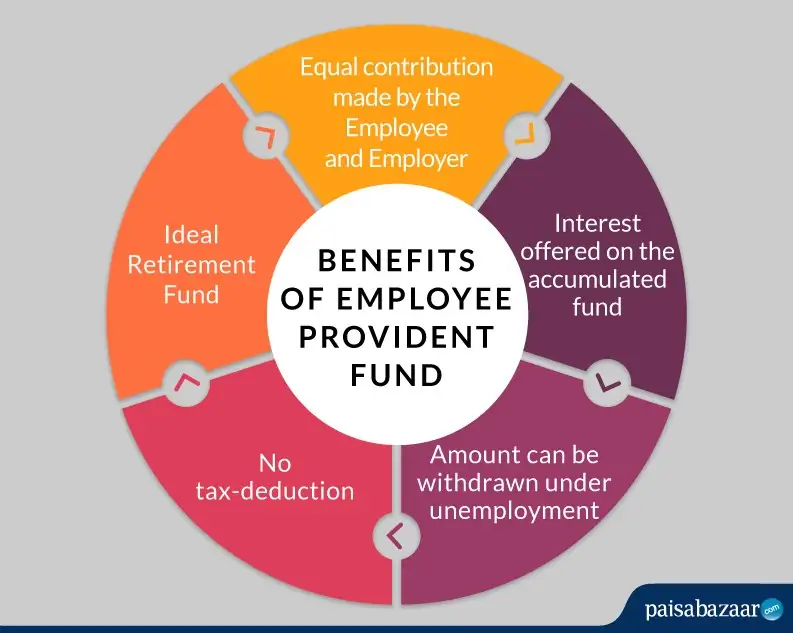

Under this it is mandatory for all the employees whose income is up to Rs 15000 per month to contribute 12 of the basic salary and dearness allowance. Besides this it is also mandatory for employers to make an equal PF contribution of 12. However this contribution cannot exceed Rs 1250 ie.

Though an organization ends up paying more admin charges on PF if the. Employers have to revise the PF deductions from September 2014 onward for all employees whose basic salary is less than or equal to Rs15000. I think this will be helpful to you.

Employers will separate these amounts in the EPF ECR file and make the payments every month. Those who earn beyond that Rs 180 lakh or more as basic salary per month would get impacted. PF deductions whether to be done on ceiling limit or actual basic pay is mostly mutual between the organizations n employees.

Believing that your basic salary is more than Rs. But employees can deposit PF contribution even above 15000 Rs basic wage as per their wish but your employer can limit their contribution to 15000 basic wage only. 1800 or 12 of Basic salary.

Employers contribute towards their Employees Provident Fund EPF at the rate of 12 of the basic salary from which 833 of their individual monthly salaries goes into the Employees Pension Scheme EPS. However employers can limit the PF deduction to 12 of 15000 even if the basic salary is higher. 1800 which is 12 of Rs.

Example for each employee getting wages above 15000 amount will be 75- 3. 15000 per month in the EPS Scheme. However you have the option to limit this deduction upto Rs.

4 lignes To calculate PF of basic salary of more than 15000 Rs follow the below calculation process. 1 which is 12 of Rs. For example if your basic salary and dearness allowance add.

Employees Provident Fund Or Epf Rules For Employer

Pf Esi Calculation Excel Format 2021 Download

Epf Payment Online Procedure Receipt Download Late Payment Penalty

Employees Provident Fund Epf Wage Ceiling Pf Deduction On Rs 21 000 Instead Of Rs 15 000 Likely Soon Zee Business

Pf Scheme It S Features Benefits Resolveindia Blog

All Employee Provident Fund Questions Answered

Employee Provident Fund Epf Changed Rules From 1st Sept 2014 Sap Blogs

Employee Provident Fund Epf Contributions Benefits Tax Vrs Scripbox

Employee Provident Fund Epf Epf Eligibility Balance Claim Status

Latest Provident Fund Rule Epf Contribution Must For Special Allowances Part Of Your Basic Salary Zee Business

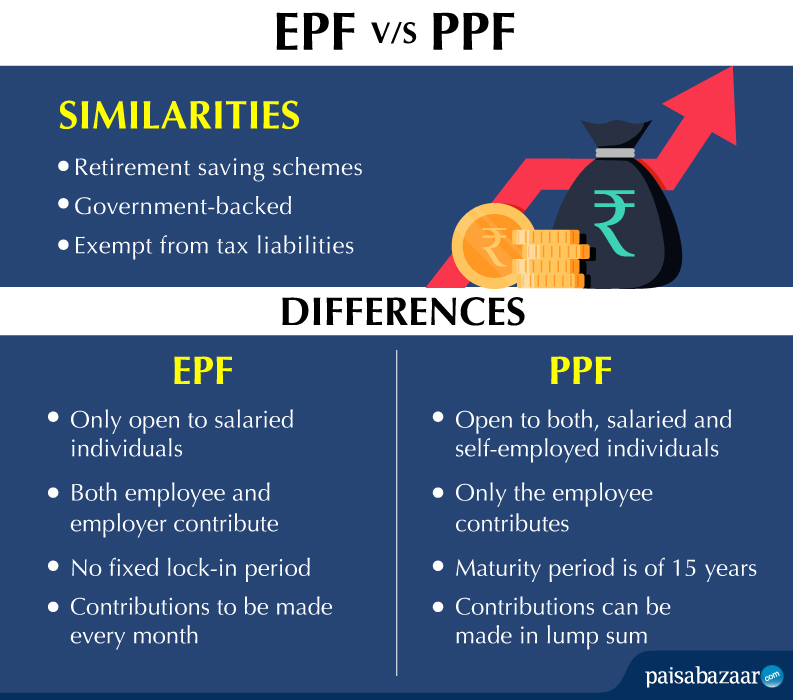

Differences Between Epf And Ppf That You Must Know About

Is It Mandatory To Deduct Pf From Salary More Than 15000

Pin By Tallygame On Taxin Fund Employee General Partnership

Rates Of Pf Employer And Employee Contribution Pf Provident Fund

Epf Interest Rate 2020 21 How To Calculate Interest On Epf

Pf Contribution Rates And Universal Social Security

Pf Relief May Be Taxing In The Long Term

Who Is The Eligibility For Employee Provident Fund Abc Of Money

Post a Comment for "Basic Salary Limit For Pf"