13th Month Pay Journal Entry

You should pay them 112 of their basic salary for that period. Reversing a Selected 13th Month Journal Entry.

Accounting Principles 7 Th Edition Weygandt Kieso Kimmel

In other months and in some years the last full workweek might end on the 28th of the month.

13th month pay journal entry. Journal Entry For Accrued Expenses. Reversing a Selected 13th Month Journal Entry. Regardless of whether an employee still work for you at the end of the year or not you still need to pay their accrued 13th month.

It is quite shocking how many employers arent aware that they are liable for the 13th month an employee has accrued during their employment. On the Employee Profile go to Banks. Any company that hires employees internationally is required to comply with the host countrys employment and compensation laws and labor rights.

Recording the payroll process with journal entries involves three steps. All rank and file employees regardless of their designation or employment status who have worked at least one month during the calendar year are entitled to a 13th month pay. Provide a short description of the article.

Where an employee resigns or is terminated from their employment at any time during the year the employee is still entitled to receive a 13th Month Pay benefit but based only on the number of months the employee was employed during the year and salary paid. Provide a short description of the article. Here the expenditure account is debited and the accrued liabilities account is credited.

13th Month Pay for Resigned or Terminated Employees. Salary is paid to the partners of the partnership firm only if it is specified in the partnership deed. Once the year end has been processed the income and expense accounts are zeroed out for that year and written to the Retained Earnings account.

The following are the steps to record the journal entry for salary to partners. 13th period journal entries can be done on an expired general ledger. Every level of employee is entitled to 13th month pay as long as they have worked at least one month during the calendar year.

Bank Register Spend Money and Receive Money transactions Transfer Inventory. The title appears in the article and in search results. 13th-month payalso sometimes referred to as the 13th-month bonus 13th-month salary or thirteenth salaryis a monetary benefit that is either mandatory by law or customary for the countries that participate.

If you use the base pay or gross pay. This type of journal entry allows the user to do journal entries into the prior year. Sometimes it necessary to make adjustments to accounts once the year has ended.

It is calculated as 112 of the total basic salary earned during the year. To record the salaries and withholdings for the work period of December 16-31 that will be paid on December 31. Juan earns a basic salary at Php15000 per month at company ABC.

This is required so that all of the expenses actually occurring during the month are matched with the revenues of the month. The title appears in the article and in search results. Reposting a 13th Month Journal Entry Flex.

It is paid out in two 50 installments in June and. Salaried Payroll Entry 1. Your 13th month pay should be not less than 112 of the total basic salary you earned within the calendar year.

When the company settles its obligation with cash the accrued liabilities account is debited and the accrued. Journal Entry for Salary to Partners. Apr 28 2021 Knowledge.

On the main dashboard go to Employees then Employee List and select the name of the employee to update from the list. Argentina takes a different approach to the 13th month pay and it is calculated based on 50 of the years highest monthly salary. In that case the employer will need to estimate the payroll and payroll-related expenses for the 29th 30th and 31st days of the month.

On this screen you will see the amount of the 13th month the employee has accrued throughout the year on PayrollHero see screenshot. To check your employees current 13th month accrual. Let say an employee basic salary is Php15000 per month and had worked for 10 months the 13th month computation is.

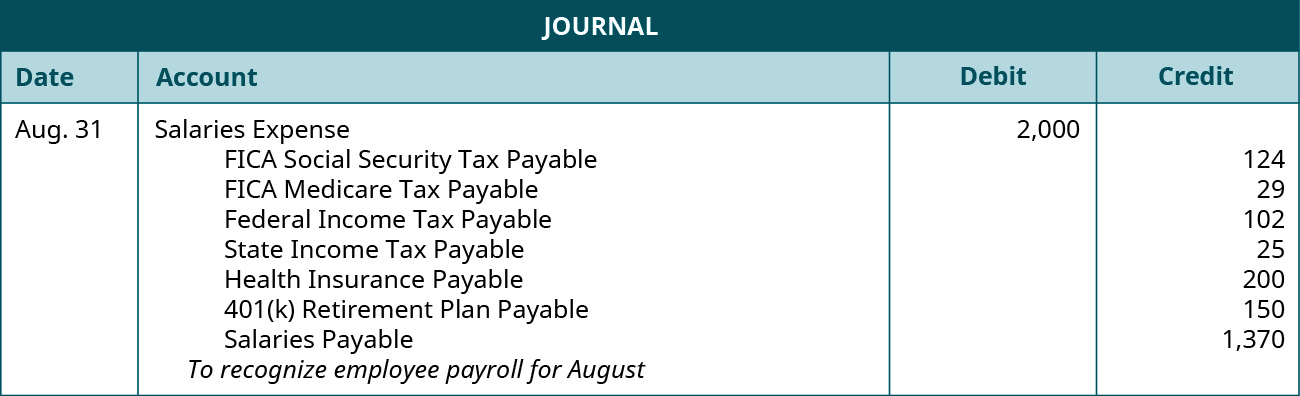

In addition to the salaries recorded above the company has incurred additional expenses pertaining to the salaried payroll for this semi-monthly period of December 1631. He has been working for 10 months in the. 13th month journal entries are mostly the same as a regular journal entries.

Php15000 X 10 months. This means your 13th month pay is monthly basic compensation computed pro-rata according to the number of months or days you have worked in your company. Those estimates will be used to record an accrual-type adjusting entry on the 31st.

The 13th month pay shall be in the amount not less than 112 of the total basic salary earned by the employee within the Calendar day. The important word their is accrued. Accruing payroll liabilities transferring cash and making payments.

The 13th period is available for the following transaction types. Accrued expense journal entry is passed to record the expenses which are incurred over one accounting period by the company but not paid actually in that accounting period. These expenses must be included in the December financial statements as shown in the next journal entry.

Here is the basic 13th month pay formula in the Philippines. To compute your 13th month pay multiply your basic monthly salary to the number of months you have worked for the entire year then divide the result to 12 months. Reposting a 13th Month Journal Entry Flex Nov 27 2019 Knowledge.

Step 1 Journal entry for salary due. Monthly Basic Salary x Employment Length 12 months. Types of payroll journal entries.

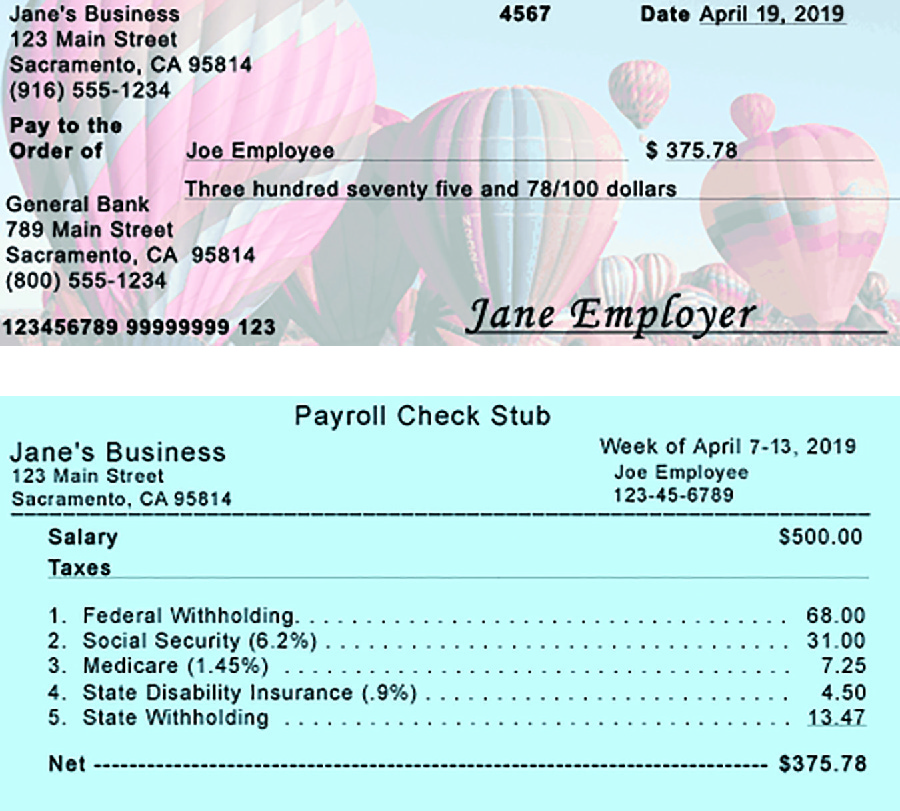

How To Export Quickbooks Journal Entry On Payrollhero Payrollhero Support

Payroll Journal Entries For Wages Accountingcoach

How To Export Quickbooks Journal Entry On Payrollhero Payrollhero Support

Payroll Journal Entries For Wages Accountingcoach

Accounting Principles 7 Th Edition Weygandt Kieso Kimmel

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

General Ledger Windward Accounting Software Point Of Sale And Inventory Control

3 1 Prepared By Coby Harmon University Of California Santa Barbara Intermediate Accounting Prepared By Coby Harmon University Of California Santa Barbara Ppt Download

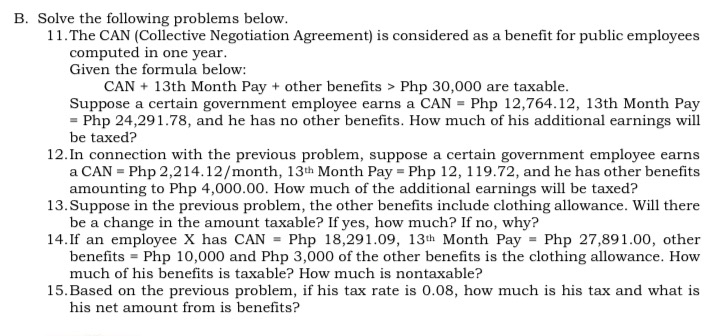

Answered 11 The Can Collective Negotiation Bartleby

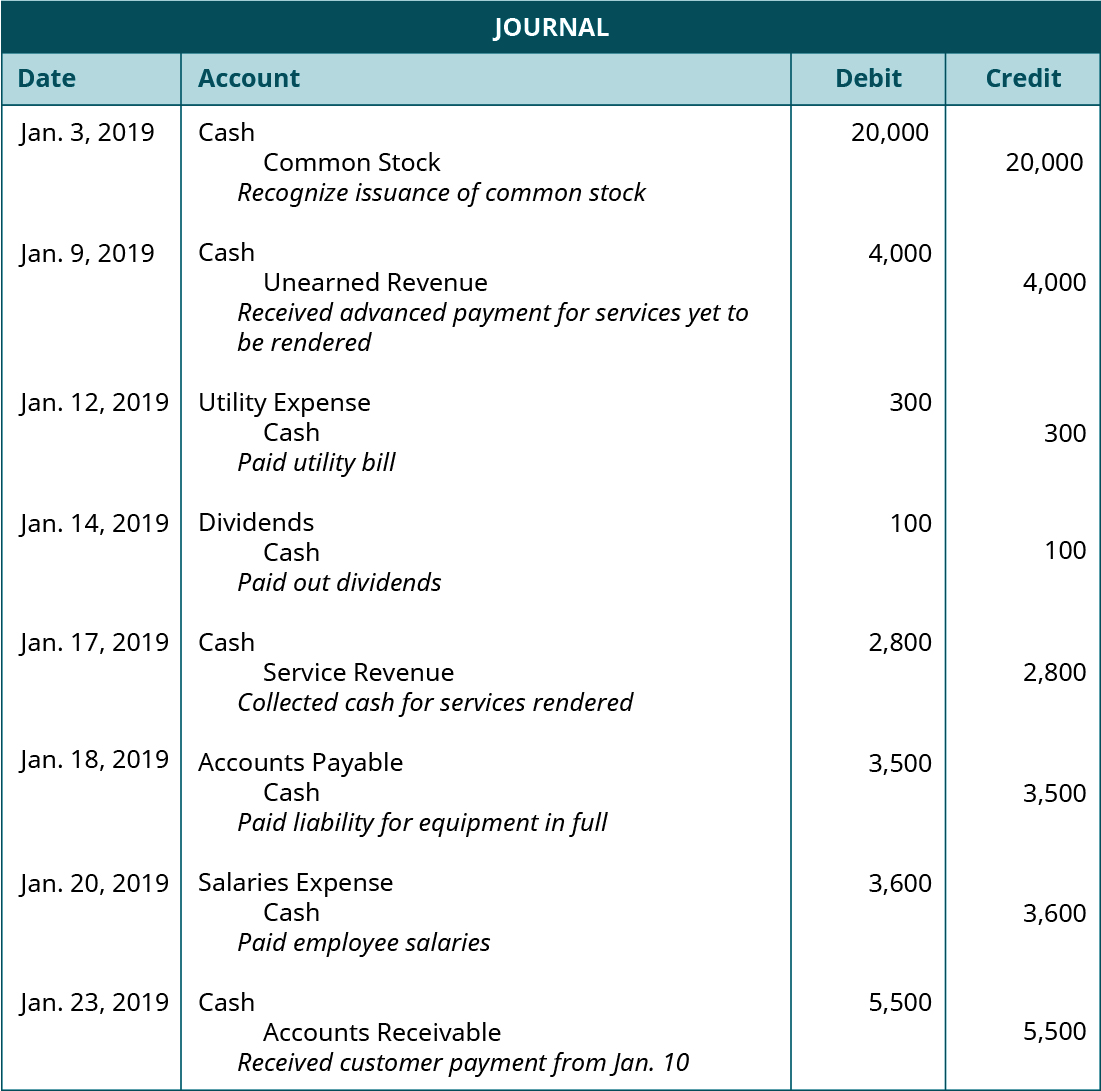

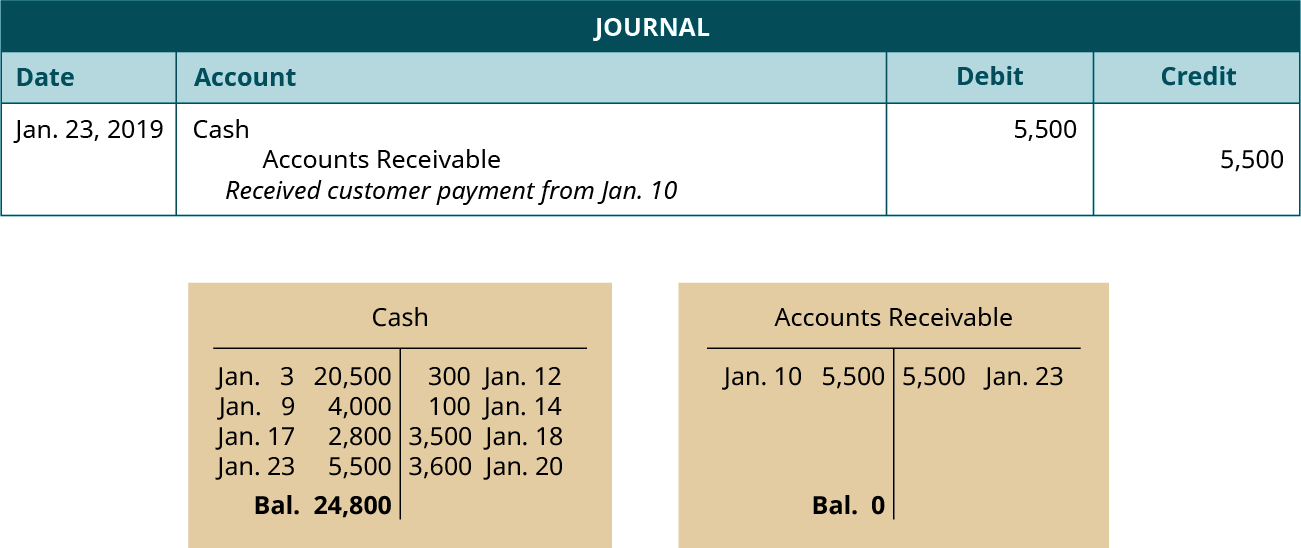

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Accounting Principles 7 Th Edition Weygandt Kieso Kimmel

Payroll Archives Dayanan Business Consultancy

Managerial Accounting By G Norren Chap004

Payroll Journal Entries For Wages Accountingcoach

Payroll Journal Entries For Wages Accountingcoach

Accounting Principles 7 Th Edition Weygandt Kieso Kimmel

Accounting Principles 7 Th Edition Weygandt Kieso Kimmel

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Post a Comment for "13th Month Pay Journal Entry"