Semi Monthly Salary Calculator Ontario

The adjusted annual salary can be calculated as. Semi Monthly Salary Calculator.

If He Or She Passes Away Within The Term Of The Policy The Life Insurance Coverage Business Will Pay The Recipien Budgeting Money Budgeting Budgeting Finances

Calculate the nominal work hours in each pay period.

Semi monthly salary calculator ontario. Let us assume that an employee earns gross 100000 annually. 30 8 260 - 25 56400. The semi monthly payment method requires payment of wages twice every month.

Here are the features that make this semi-monthly timesheet calculator so quick and easy. The calendar year has 2080 hours. Enter your pay rate.

Select the province. The calculator is updated with the tax rates of all Canadian provinces and territories. The Canada Monthly Tax Calculator is updated for the 202122 tax year.

It is not as complicated as calculus or trigonometry. See how we can help improve your knowledge of Math Physics Tax Engineering and more. Use the simple monthly Canada tax calculator or switch to the advanced Canada monthly tax calculator to review NIS payments and income tax deductions for.

Also as you should know there are 2080 workdays in a calendar year 52 weeks multiplied by 40 hours. Annual Salary Paid Employees Only whether paid bi-weekly semi-monthly or other Enter annual salary. Hourly Pay Rate.

Before taxes or any other deductions Gross Monthly Pay. Prorate this salary based on the nominal work hours above and Caroles hours worked from. This video will show how to calculate the CEWS using the spreadsheet available from the Canadaca Government Website for employees that are paid a salary on.

Pay Frequency 52 - Weekly 26 - BiWeekly 12 - Monthly 04 - Quarterly 01 - Yearly 24 - Semi-Monthly 22 - 22 Pays a year 13 - 13 Pays a year 10 - Pays a year. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. The amount can be hourly daily weekly monthly or even annual earnings.

As a result of this salaried employees are paid for 8667 hours each semi-monthly pay period. Divide 66000 by the number of periodsyear or 24. You may not even need a calculator to determine the employees daily rate.

4700000 salary example for Ontario in 2021. The 2021 Ontario Tax Calculator provides free online tax calculations for Ontario province tax and Federal Tax tables in 2021. Annual salary without commas average weekly hours Take one of the two calculated amounts from the boxes on the right.

Contributions for SSS and PhilHealth are increasing on 2021. Sweldong Pinoy is a salary calculator for Filipinos in computing net pay withholding taxes and contributions to SSSGSIS PhilHealth and PAG-IBIG. Youll then get a breakdown of your total tax liability and take-home pay.

This free online semi-monthly timesheet calculator with 2 unpaid breaks and overtime will add up your or your employees time clock hours twice a month and calculate your gross wages. This is required information only if you selected the hourly salary option. If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 24.

Gross annual income - Taxes - Surtax - CPP - EI Net annual salary. Your average tax rate is 220 and your marginal tax rate is 353. One of a suite of free online calculators provided by the team at iCalculator.

Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income. The answer is 2750. That means that your net pay will be 40568 per year or 3381 per month.

Formula for calculating net salary. Enter the number of hours worked a week. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

Enter the number of pay periods. For 2021 employers can use a BPAF of 13808 for all employees while payroll systems and procedures are updated to fully implement the proposed legislation. Calculate Caroles normal pay period salary.

Where NI 151978 BPAF 13808. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Pay Unit Hourly Rate Daily Rate Weekly Rate Monthly Rate Yearly Rate.

Net annual salary Weeks of work year Net weekly income. Now since there are 12 months in a year a semi monthly payment system would therefore have 24 pay periods 122. All bi-weekly semi-monthly monthly and quarterly figures.

Now you can go back to the Dues or Strike Calculator you were working on and enter the. If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary. Where 151978 NI 216511 BPAF 13808 - NI - 151978 1387 64533 Where NI 216511 BPAF 12421.

Divide that number by 2 and you have the semi-monthly salary. 375 hoursweek times a fixed 52 weeks divided by the number of periodsyear or 24. Your average tax rate is 222 and your marginal tax rate is 361this marginal tax rate means that your immediate additional income will be taxed at this rate.

This marginal tax rate means that your immediate additional income will be taxed at this rate. The answer is 8125. You can calculate this by dividing the 2080workdayss by the 24 semi-monthly payrolls.

You can calculate your Monthly take home pay based of your Monthly gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables.

Paycheck Calculator Take Home Pay Calculator

Mortgage Calculator Home Loan Calculator Infochoice Mortgage Payment C Mortgage Loan Calculator Mortgage Loan Originator Mortgage Amortization Calculator

Retirement Calculator Spreadsheet Simple Budget Template Retirement Calculator Budget Template

Staffing Plan Template Excel Spreadsheet Excel Plan Spreadsheet Staffing Templa Business Case Template Business Plan Template Progress Report Template

3 500 A Month After Tax Us August 2021 Incomeaftertax Com

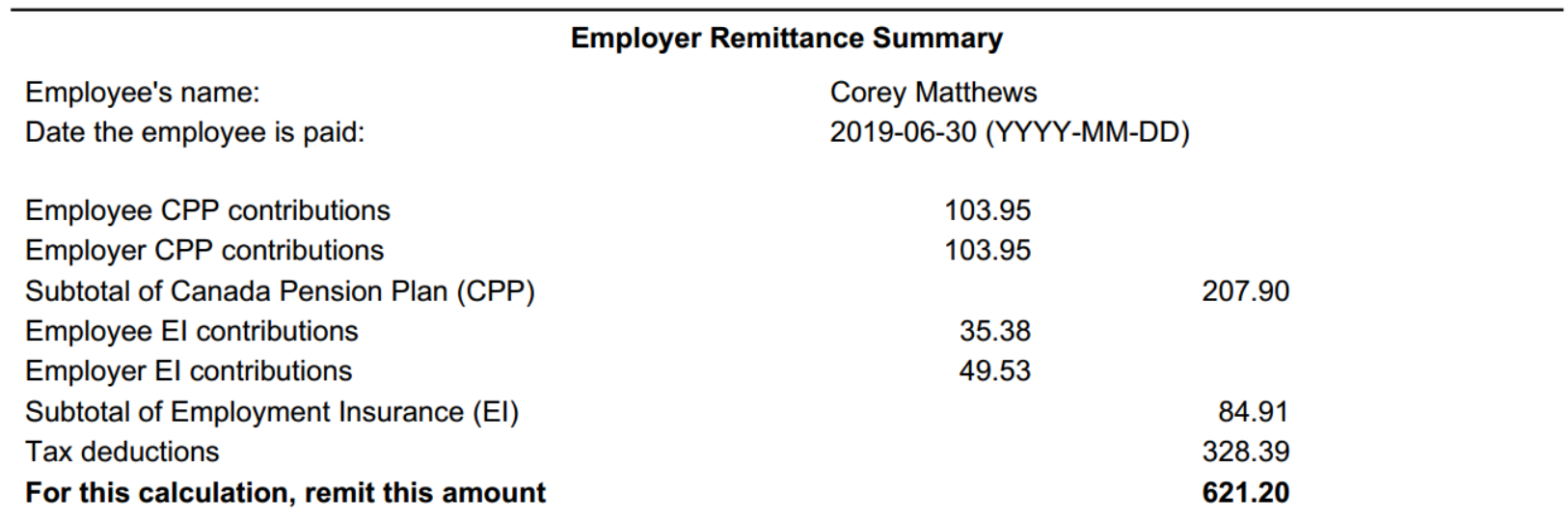

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Find The Lowest Mortgage Rates From Canada S Leading Banks And Mortgage Agent Just Like That Bi Lowest Mortgage Rates Mortgage Payment Mortgage Interest Rates

How To Calculate Your Monthly Car Payments

Use Accelerated Bi Weekly Mortgage Payments To Eliminate Your Mortgage Faster Mortgage Payment Mortgage Payoff Paying Off Mortgage Faster

Paycheck Calculator Take Home Pay Calculator

Mortgage Calculator Visit Our Site Biweekly Mortgage For More Information On Bi Weekly Mortgage Amortization Calculator Biweekly Mortgage Mortgage Amortization

Free Finance Printables For Your Budget Binder Budget Binder Free Excel Budget Excel Budget

Central Mortgage Company Home Mortgages Mortgage Nef2 Com Central Mortgage Refinancing Mort Mortgage Loan Calculator Mortgage Companies Refinance Mortgage

Payoff Mortgage Early Or Invest The Complete Guide Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

Bi Weekly Mortgage Calculator All Western Mortgage Use All Western Mortgage S Biweekly Mortgage Amortization Calculator Mortgage Loans Mortgage Amortization

Usage This Biweekly Automobile Payment Calculator To See For Yourself Exactly How Making Biweekly Settlements Mortgage Payment Calculator Car Loans Weekly Pay

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Budget

How To Negotiate Your Debt With Collectors Deudas Making Ideas Dinero

Post a Comment for "Semi Monthly Salary Calculator Ontario"