Net Income Payable Meaning

Tax payable is not considered a long-term liability but rather a current liability. Some people refer to net income as net earnings net profit or the companys bottom line.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

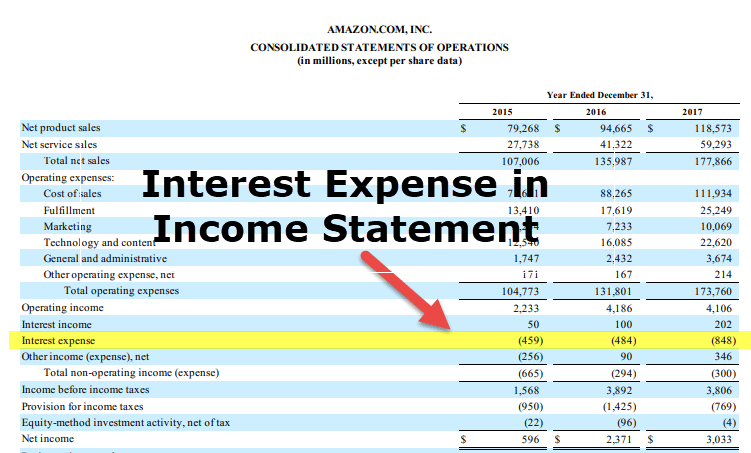

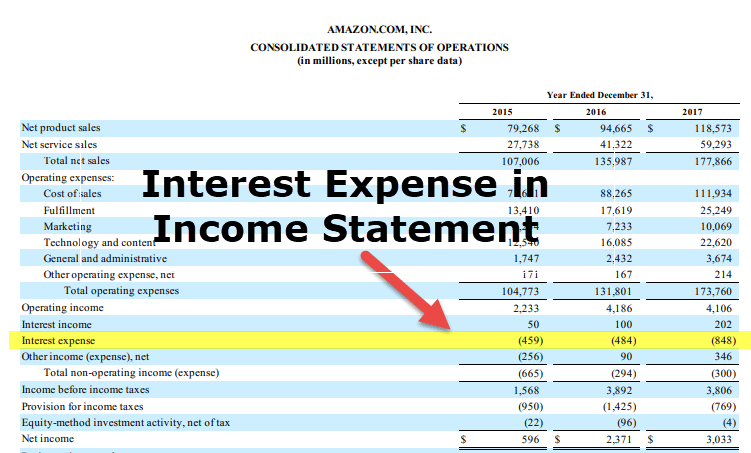

Income Statement Definition Uses Examples

Definition of Interest Payable Interest payable is the interest expense that has been incurred has already occurred but has not been paid as of the date of the balance sheet.

Net income payable meaning. Net Income for Businesses Net income for a business represents the income remaining after subtracting the following from a companys total revenue. Your net income from your business in the example above is 50000. Its the amount of money you have left over to pay shareholders invest in new projects or equipment pay off debts or save for future use.

The money was payable as a lump sum quantified in advance when it could not be foreseen what damages might have to be paid in the event of an accident. Net income is your companys total profits after deducting all business expenses. The relevant formulas have been organized and presented by chapter.

V-link ADJ oft ADJ onto n Purchase tax was not payable on goods for export. For business valuation purposes enterprise value is typically. Need an all-in-one list with the Financial Reporting and Analysis formulas included in the CFA Level 1 Exam.

Tax payable non-refundable tax offsets Net tax payable on taxable income 4. If you are registered as self-employed or a small business and you are selling to another business the net price is generally more appropriate as if the business is VAT registered they will be able to claim back the VAT charged in your invoice. Loans from banks are included in this account.

Interest payable does not include the interest for periods after the date of the balance sheet Example of Interest Pa. This forms your net tax payable. Net tax payable HELP debt repayments Medicare levy and.

In this sense they will be interested in viewing the total price without the tax included - the net. The calculation of income tax. To determine the net tax payable on your taxable income use this formula.

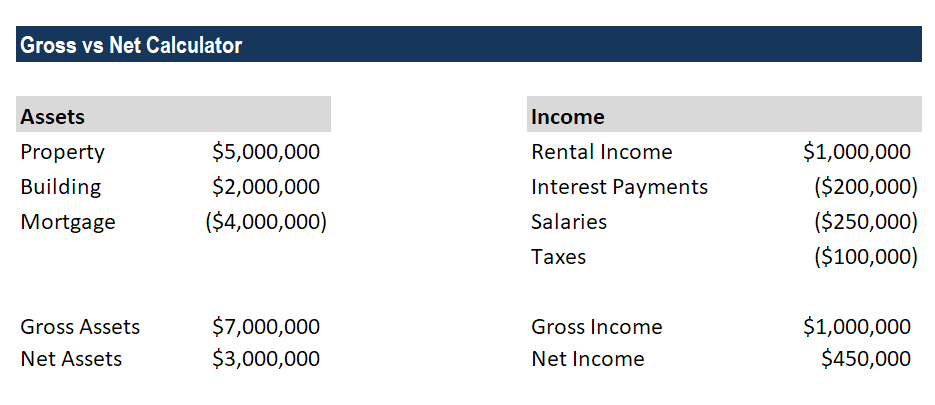

The amount of liability will be based on its profitability during a given period and the applicable tax rates. Net income is the sum total of all revenue expenses debts taxes interest and additional income for a given period. The Enterprise Value Enterprise Value EV Enterprise Value or Firm Value is the entire value of a firm equal to its equity value plus net debt plus any minority interest of a business is equal to its equity value plus its net debt.

You get net income by subtracting expenses from income. Net Payable Amount means in respect of a Billing Period or other period the amount calculated in accordance with Clause 236 Calculation of Net Payable Amount. Assessable income allowable deductions Taxable income 2.

De très nombreux exemples de phrases traduites contenant net income payable Dictionnaire français-anglais et moteur de recherche de traductions françaises. It is compiled of taxes due to the government within one year. 1 adj If an amount of money is payable it has to be paid or it can be paid.

As a general rule in English law there is no need to give. Income tax payable is a type of account in the current liabilities section of a companys balance sheet. The tax effect relating to the timing differences between the corporate income tax payable in relation to the expense for this tax is recorded as deferred tax asset or liability.

We have compiled them for you here. Income Tax is levied on a person who was in India for 182 days during the previous tax year or the person who was in India for at least 60 days during the previous tax year and for at least 365 days during the preceding 4 years will be taxed. Calculate Taxable Income on Salary.

Net income is the amount of money thats left after taxes and certain deductions are made from gross income. To get the net of tax calculation you must subtract the taxes due on that income. 1 predicative of money required to be paid.

Interest is payable on the money owing. Like other accounting measures it is susceptible to manipulation through such. Income tax payable is a term given to a business organizations tax liability to the government where it operates.

In this section we will cover the following topics Basics of Accounting Income Statements Balance Sheets Cash Flow Statements Financial Analysis Techniques Inventories. Net income can also be called net profit the bottom line and net earnings. The reason that cash is deducted from debt is that it can be used to net out any amounts that are owed to creditors.

For a business ordinary income that is subject to tax is net income profit. Taxable income x relevant marginal tax rate Tax payable on taxable income 3. Income tax and self-employment tax Social Security and Medicare.

Your customer sees the total price and can subtract the tax to be able to determine the net amount. The amount of principal due on a formal written promise to pay. Income tax is the tax you pay on your income.

Net Profit Formula Definition Investinganswers

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Interest Expense In Income Statement Meaning Journal Entries

The Difference Between Gross And Net Pay Economics Help

Gross Vs Net Learn The Difference Between Gross Vs Net

Net Income The Profit Of A Business After Deducting Expenses

Income Statements Explained Accountingcoach

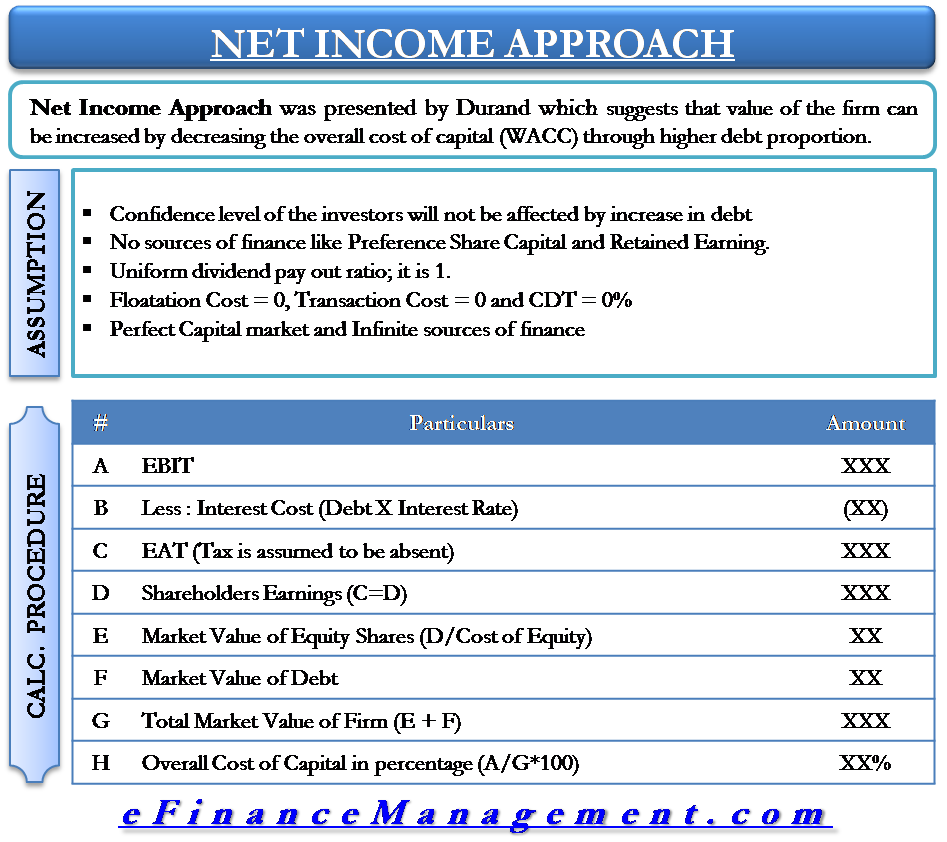

Capital Structure Theory Net Income Approach

How Do Net Income And Operating Cash Flow Differ

How Do Earnings And Revenue Differ

Net Income Example Formula Meaning Investinganswers

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

Income Statement Definition Uses Examples

Net Income Example Formula Meaning Investinganswers

Ebit Vs Ebitda Vs Net Income Ultimate Valuation Tutorial

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

How To Calculate Net Income Formula And Examples Bench Accounting

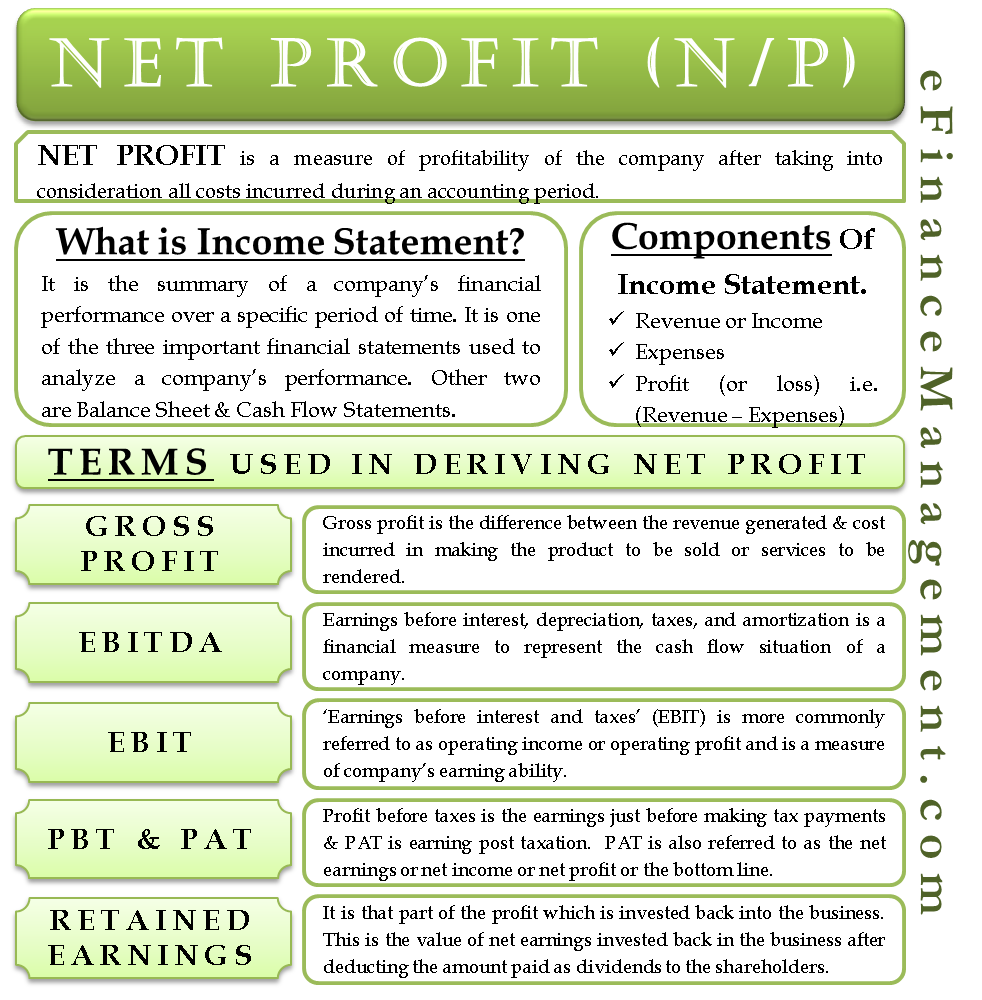

Net Profit Income Statement Terms Ebit Pbt Retained Earnings Etc

Ebit Vs Operating Income What S The Difference

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Net Income Payable Meaning"