Total Annual Income To Get Approved For Credit Card

For millions figuring out what counts as annual income for the sake of a credit card application can be surprisingly murky. Therefore do not lie about exaggerate or inflate your actual income.

How To Qualify For A Small Business Credit Card And Why You Should Get One Credit Card Application Form Business Credit Cards Credit Card Application

740 to 799 is considered excellent credit.

Total annual income to get approved for credit card. M1 Finance finally reveals details on their newest credit card which provides users with a whopping 10 Cashback on the companies they invest in. 670 to 739 is considered good and 580 to 669 is considered fair credit. Multiply your answer by 52 weeks in a year.

Dec 13 2018 Sorry if youre looking for a magic number but theres no mandated total annual income for credit card approval. This article highlights a number of factors that Goldman Sachs uses in combination to make credit decisions but doesnt include all of the details factors scores or other information used to make. For this years application I got denied initially because the letter my parents wrote to Capital One was not specific enough so they didnt count it in my income review.

You have your annual or yearly salary. It is unlikely that the lender will prosecute you for falsifying. The total income you report on your credit card application can be an important factor in receiving approval and the amount of your credit limit.

The minimum income requirement for basic credit cards typically sits above 12000 while for premium credit cards you could be required to make as much as 100000. If youre paid weekly but the credit card application asks for your monthly income multiply your weekly income by 52 and then divide the result by 12. You have monthly payments on your auto loan 200 student loan 250 and mortgage 800 for a total of 1250.

Using your calculator or computer multiply your hourly rate by the number of hours you work in a week. A score of 579 or lower is considered poor. Though the CARD Act doesnt state any specific minimum income requirement credit card companies do have to ensure applicants have enough income.

Heres a guide to the process. Different cards have different criteria and you can find them here. You can include things like.

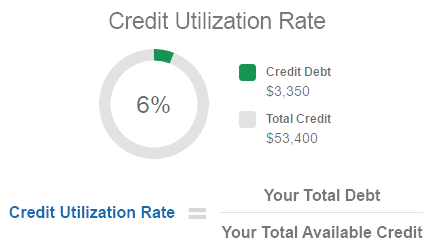

For the best chance of being approved for a credit card you want this number as low as possible. Chase Sapphire Preferred Visa Signature - 12700 CL Chase United MileagePlus Club World Elite MasterCard - 26500 CL. The federal CARD Act requires you to be at least 21 to get a student credit card in your name although you can apply as young as 18 if you have sufficient income or a cosigner who is at least 21.

Message 2 of 51. Most banks allow you to include income beyond traditional salaries and wages. When you divide your monthly debt 1250 by your monthly income 3000 you get a DTI of about 42.

Some may ask for proof of your income so have a copy of your pay stubs bank statements or other income available If your credit card application asks for your annual income and youre paid weekly multiply your weekly amount by 52. Theres no single minimum income you need in order to get a credit card. Banks make decisions about how much money to put at risk based on answers.

And lying about it could get you approved but it could also get you in trouble. Citibank Hilton Reserve Visa Signature - 20000 CL JP. Theres no one score that you have to have to get credit card approval.

Estimating your annual income in good faith and coming up short is completely understandable. Inventing self-employment income grossly inflating your actual 2. Your income is required when you apply for a new credit card.

Morgan Ritz Carlton Visa Signature - 23500 CL. You can use a calculator to convert hourly wages into a salaried amount. If your take-home pay is 600 per week after taxes retirement contributions and premiums for health insurance are taken out for example your estimated annual net salary.

As a general guideline a score of 800 or higher is considered exceptional. Gross annual income is your total earnings from all sources in a calendar year. Net annual income is the gross figure minus deductions for taxes insurance 401K contributions etc.

Find out more about how much youll need to earn to get a credit card in Canada and. If it asks for monthly income multiply your weekly amount by 52 and then divide by 12. Im a student who only makes 3000 a year so I understand why I got denied the first time however I have pretty good credit score 750 so the only thing holding me back is my income.

Credit card issuers look at a 1. If you would like to receive a credit card limit of 5000 you will need a combination of excellent credit history and high personal income. 240 multiplied by 52 weeks in a year is 12480.

Goldman Sachs 1 uses your credit score your credit report including your current debt obligations and the income you report on your application when reviewing your Apple Card application. Many credit card providers require you to earn a minimum annual income for a credit card. Ie - if you have Amazon or Netflix in your portfolio you earn up to 10 back on their products.

Investment income from stocks and rental properties. For example if you earn 800 per hour and work 30 hours per week you have 240. Newest card on the market by M1 - 10 Cash Back.

Decoding Your Credit Card Billing Statement Credit Card Statement Credit Counseling Credit Card

Natwest Reward Credit Card The Point Calculator Rewards Credit Cards Credit Card Points Credit Card

Mission Lane Classic Visa Credit Card Reviews August 2021 Credit Karma

Find The Best Low Interest Credit Card For You Credit Card Help Paying Off Credit Cards Credit Card Debt Payoff

What Is A Credit Utilization Rate Experian

Www Totalcardvisa Com Apply For Total Visa Card Rebuild Your Credit Best Credit Cards Visa Credit Card Unsecured Credit Cards

How To Apply For Total Visa Credit Card Good Credit Best Credit Cards Credit Card Design

Sofi Credit Card Full Details Released Card Rolling Out In 2021 Credit Card Cards Sofi

High Impact Factors That Affect Your Credit Score Credit Score How To Get Rich Credit Card

This Credit Card Calculator Will Calculate Your Minimum Monthly Payment Given A Credit Card Balance An Paying Off Credit Cards Credit Card Balance Credit Card

Top 5 States In Credit Card Debt And Do You Live In One Of Them Credit Cards Debt Credit Card Balance Credit Card

Note That Even If You Pay Off Your Credit Cards In Full Each Month Your Credit Report May Show A Balance On Those Cards The Total Balance On Your Last Stateme

Do You Have Too Much Debt Debt Ratio Debt To Income Ratio Financial Literacy

Credit Card Dashboard App Design Layout Dashboard Design Financial Dashboard

Pin By Moundreso On My Saves Pre Approved Credit Cards Lettering Card Template

What Credit Limit Will I Get When I Apply For A Credit Card

Personal Loans Online Personal Loans Online Credit Card Cash Rewards Credit Cards

Post a Comment for "Total Annual Income To Get Approved For Credit Card"