Monthly Salary Calculator Nyc

The New York Minimum Wage is the lowermost hourly rate that any employee in New York can expect by law. Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more.

Your Budget Example Monthly Expense Calculator College Budgeting Job Hunting

One of a suite of free online calculators provided by the team at iCalculator.

Monthly salary calculator nyc. All bi-weekly semi-monthly monthly and quarterly. The results are broken down into yearly monthly weekly daily and hourly wages. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. If you make 55000 a year living in the region of New York USA you will be taxed 12213. In New York the standard deduction for a single earner is 8000 16050 for joint filers.

Calculate your New York net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New York paycheck calculator. If you live in one location but work in another the. Supports hourly salary income and multiple pay frequencies.

Can be used by salary earners self-employed or independent contractors. The law states that. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. 7000000 salary example for employee and employer paying New York State tincome taxes. In order to determine an accurate amount on how much tax you pay be sure to.

For instance for Hourly Rate 2600 the Premium Rate at Time and One-Half 2600 X 15 3900 For premium rate Double Time multiply your hourly rate by 2. The New York Salary Calculator allows you to quickly calculate your salary after tax including New York State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting New York state tax tables. ---Select Country--- Afghanistan Albania Algeria Angola AntiguaBarbuda Argentina Armenia Australia Austria Azerbaijan Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bhutan Bolivia Bosnia-Herz.

The adjusted annual salary can be calculated as. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. That means that your net pay will be 42787 per year or 3566 per month.

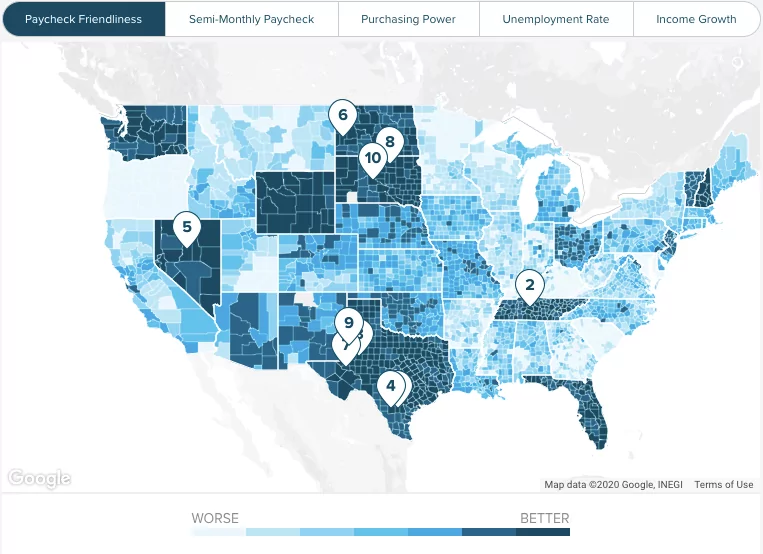

New York Tax Credits. Use our calculator to discover the New York Minimum Wage. You can see how your job and your salary will be impacted by a change of location.

The federal minimum wage is 725 per hour and the New York state minimum wage is 1250 per hour. 30 8 260 - 25 56400. To use our New York Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Detailed salary after tax calculation including New York State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting New York state tax tables. The following is the salary conversion table that shows the hourly weekly monthly and annual salaries for hourly rates ranging from 1 to 100. Learn which neighborhoods your annual income can afford and listings that match your search.

Management 141416 Business Financial Operations 83481 Computer Mathematical 94540 Architecture Engineering 83624 Life Physical Social Science 69291 Community Social Service. The latest budget information from April 2021 is used to show you exactly what you need to know. Why not find your dream salary too.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Check out our new page Tax Change to find out how. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. One of a suite of free online calculators provided by the team at iCalculator. Your average tax rate is 222 and your marginal tax rate is 361.

Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. Find out if you are likely to be approved for the average apartment in your chosen neighborhood. Calculate what salary you should be making to afford to live in new york city neighborhoods.

Calculating Premium Rates For premium rate Time and One-Half multiply your hourly rate by 15. Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 882 depending on taxpayers income level and filing status. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

Hourly rates weekly pay and bonuses are also catered for. This free easy to use payroll calculator will calculate your take home pay. This means that when calculating New York taxes you should first subtract that amount from your income unless you have itemized deductions of a greater amount.

There are legal minimum wages set by the federal government and the state government of New York.

Official Launch Wedding Planner Pricing Guide Wedding Planner Packages Wedding Planning Worksheet Wedding Planning Business

4 Ways To Pay Off Your Mortgage Faster Infographic Paying Off Mortgage Faster Mortgage Payoff Mortgage Fees

List Of Avm Providers Mortgage Professor Mortgage Amortization Amortization Schedule Mortgage Estimator

2018 Inbound Marketing Careers Job Salary Guide Conductor Learning Center Salary Guide Inbound Marketing Marketing Jobs

New York Paycheck Calculator Smartasset

Flat Design Vs Skeuomorphism Flat Design Design Web Design

Pennsylvania Property Tax Calculator Smartasset Com Tax Refund Calculator Income Tax Property Tax

Tara You Ve Mentioned Moving Out From The Group Home And That Is A Huge Step To Take I Have Found A Websi Moving Out Moving Out Checklist Tips For Moving Out

The 10 Levels Of New York City Office Space City Office Office Space New York City

Arrangement How To Produce Fantastic Templates Not Many Templates Are Created Equal And A Few T In 2021 Kitchen Remodel Cost Kitchen Remodel Kitchen Remodel Checklist

A Kind Reminder This Tuesday Morning Heelsandyield Investment Quotes Quotes Deep Meaningful Financial Coach

Winter Weather And The Workplace Flsa Fmla When To Pay Infographic Management Infographic Infographic Human Resources Quotes

New York Paycheck Calculator Smartasset

Salary Search In Your Area How To Remove Search Salary

Employee Bonus Excel Template Incentive Plan Calculation Etsy In 2021 Excel Templates How To Plan Incentives For Employees

New York Paycheck Calculator Smartasset

Cpa For Freelancers And The Self Employed In Nyc Small Business Cpa Manhattan Cpa Self Employed Nyc Cpa William Income Tax Tax Services Income Tax Return

Post a Comment for "Monthly Salary Calculator Nyc"