13th Month Pay May Or May Not Be Taxed

Its also great to pay attention to other aspects of your payslip like your withholding tax to anticipate any tax deficits and use your 13th month pay. 13th month holiday pay twice of daily wage Special pay 13h overtime pay125h night shift differential 11h hazard pay low wage 12h high wage 105h Retirement Benefit Formula R 225 P T where R equals retirement pay.

13th Month Pay An Employer S Guide To Monetary Benefits

Under Section 32B Chapter VI of R.

13th month pay may or may not be taxed. If the aggregate amount. Under the new TRAIN Law if the amount exceeds P90000. If you have to be absent for work take advantage of your companys leave credits or emergency leave policy to ensure you have a perfect attendance.

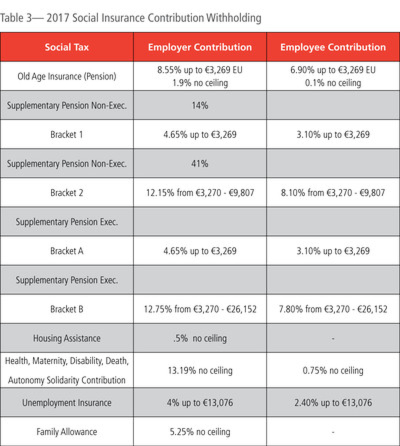

The amendment stipulates that the 13th month pay and other equivalent benefits shall not be subject to tax for a maximum of P90000. Not only do requirements vary between each country the timing and calculations for payments also do. The amount for white collar employees is usually again not always equal to 1 months pay though it is taxed higher than normal salary.

8424 the benefit must not exceed P30000. 13 th Month Pay Defined. Based on the TRAIN law your 13th month pay should not be taxed for as long as it does not exceed P90000.

In most cases if you were employed by the company for less than 6 months during the year or resigned before end of December you are not entitled to the 13th month. NOT TAXABLE PROVIDED THAT THE TOTAL AMOUNT SHALL NOT EXCEED THIRTY THOUSAND. Your 13th-month pay may be a great addition to your income.

13th-month pay is non-taxable. 10963 or the TRAIN law on January 2018. 13 th month pay also known as 13th-month bonus 13th-month salary thirteenth salary or aguinaldo or prima in Spanish is a monetary benefit beyond normal pay and optional gifts such as a Christmas or New Years bonus.

Yes it is not taxable provided that the sum received is less than Php 8200000. Under Section 32B Chapter VI of R. For the computation this formula is used.

Of your 13th month pay Christmas bonus and other incentives or benefits. From the foregoing it can be said that the 13th month pay of employees is not taxable. Otherwise it is taxed.

As set by the Department of Labor and Employment DOLE you should receive your 13th month not later than December 24 of every year. The 13th month pay is basically not taxable. Courtesy of the TRAIN Law this amount is relatively higher as compared to last years tax exclusion rate which is PHP 82000.

PESOS P3000000 P82000 in 2015. 8424 the benefit must not exceed P30000. When will I receive my 13th month pay.

However there is a prescribed limit to this exemption provided under Section 32 B7e of the National Internal Revenue Code NIRC which was amended by Republic Act No. Is 13th month pay taxable. This new amount is a relative increase from the previous tax.

The 13th month pay is every employees right and if an employer does not pay is late or does not pay in full this shall be considered improper salary. Total basic salary earned for the year 12 months proportionate 13th month pay. Is 13th month pay taxable.

Only the excess will be taxed. Any amount paid in excess of the threshold is considered taxable income. 13th month is a premium paid usually but not always in the end of the year if it is agreed on your collective labor agreement or your contract.

While payments are typically made. For the computation this formula is used. 13th month salary is not taxable i also receive same from my company every year and its paid in full.

From the foregoing it can be said that the 13th month pay of employees is not taxable. The 13th month pay is generally exempt from taxation. 13th month is a bonus that is why some companies dont pay it 13th month salary is taxed.

13th month pay is taxable if it exceeds PHP 90000. To be able to maximize your expected receivable avoid coming in late or not coming in to work. 13th Month Pay computation.

However there is a limit as to the maximum amount of the 13th month pay which is exempt from tax. Your 13th month salary is higher than your normal salary not because it is not taxed but because 8 pencom is not deducted from 13th month salary. 13th Month Pay - Free download as Powerpoint Presentation ppt pptx PDF File pdf Text File txt or view presentation slides online.

However there is a limit as to the maximum amount of the 13th month pay which is exempt from tax. Since the 13th-month pay is in the nature of a bonus our tax rules provide that the first PHP90000 received by an employee during the calendar year is exempt from income tax. This one is partly true and partly not.

Country Spotlight What To Know About Payroll In France

Everything You Need To Know About 13th Month Pay Sunstar

A 13th Month Pay Guide For Employees

Country Spotlight What To Know About Payroll In France

13th Month Pay In The Philippines Computation And Guide

How To Compute For 13th Month Pay In The Philippines Coins Ph

13th Month Pay In The Philippines Obligations For Employers Cloudcfo

Dole Guidelines For 13th Month Pay In Private Sectors

A Guide To 13th Month Pay Goglobal

How To Compute Your 13th Month Pay 2020 Jobs360

Expats Guide To 13th Month Pay And Christmas Bonus Philippine Primer

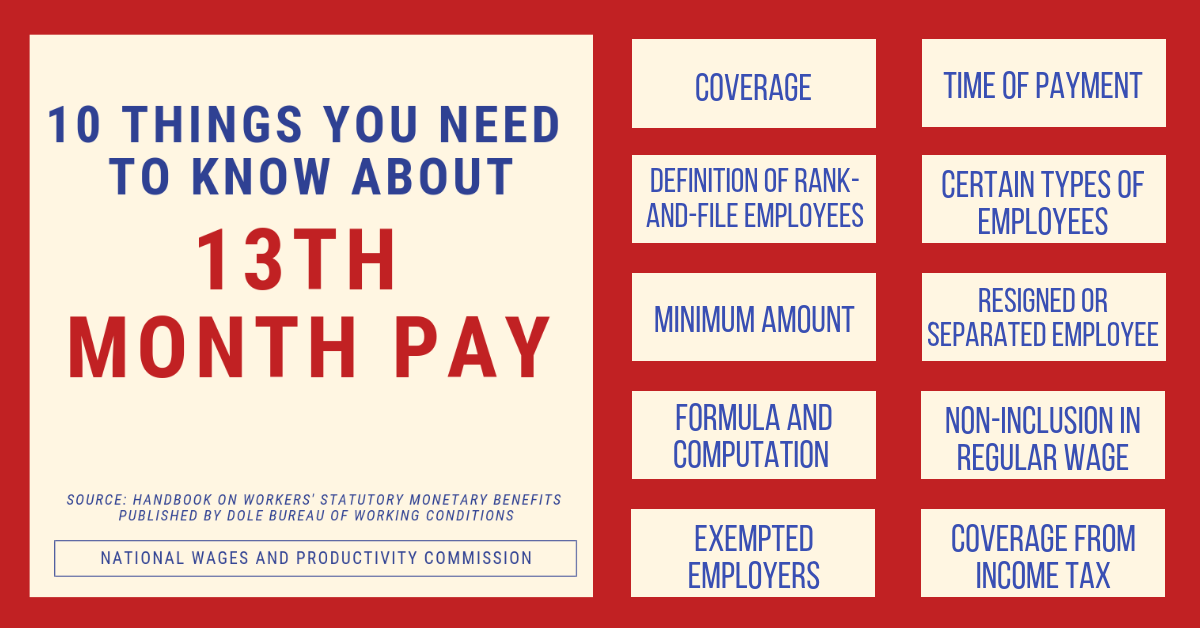

10 Things You Should Know About 13th Month

A Guide To 13th Month Pay Goglobal

13th Month Pay An Employer S Guide To Monetary Benefits

13th Month Pay An Employer S Guide To Monetary Benefits

Why The 13th Month Pay Is Not The Same As The Christmas Bonus Justpayroll

13th Month Pay Law Employee Benefits Piece Work

How To Compute 13th Month Pay In The Philippines An Ultimate Guide

10 Things You Need To Know About 13th Month Pay Dole

Post a Comment for "13th Month Pay May Or May Not Be Taxed"