Monthly Salary Calculator Philippines

Inputs are the basic salary half of monthly salary deductions other allowances and overtime in hours. Median Salary The median salary is 48200 PHP per month which means that half 50 of the population are earning less than 48200 PHP while the other half are earning more than 48200 PHP.

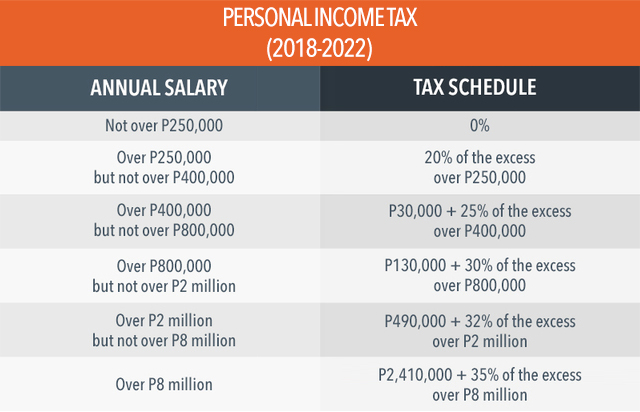

The Philippines tax calculator assumes this is your annual salary before tax.

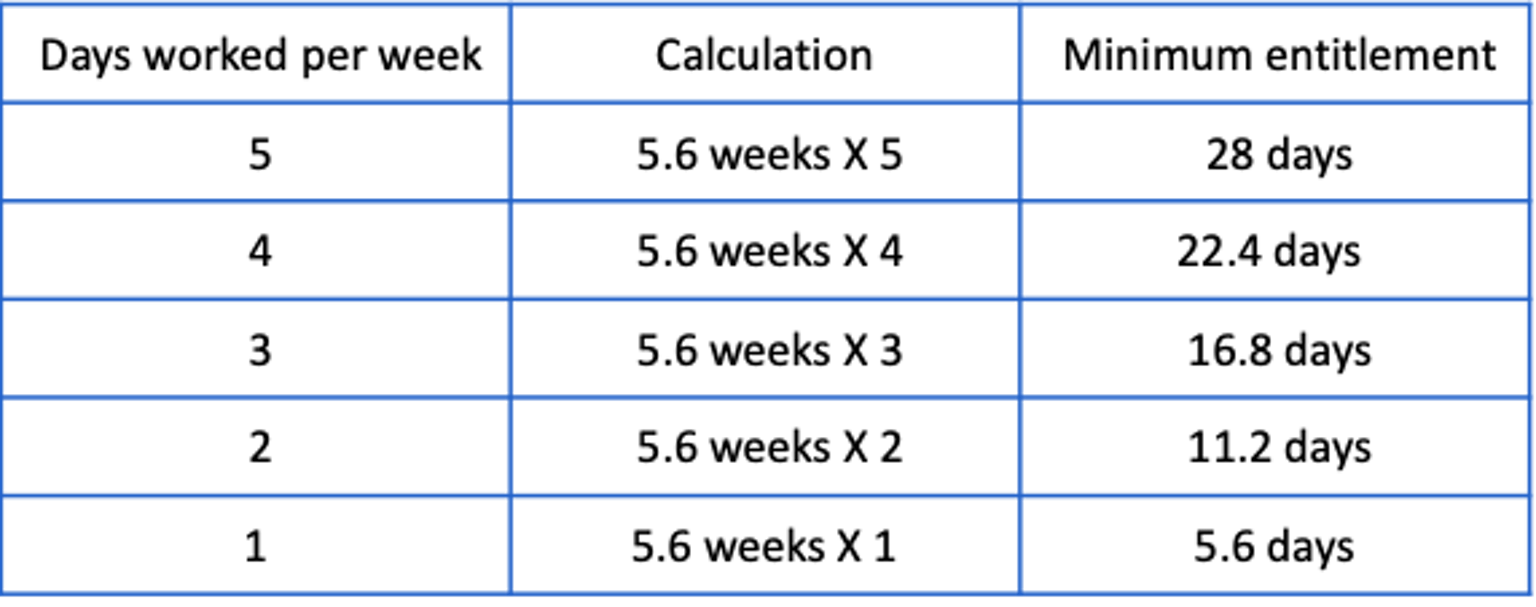

Monthly salary calculator philippines. 300 020 x 16000 pesos 002 x 16000 pesos x 42 10 300 3200 10240 13740 pesos. Salaries are different between men and women. Php 68966 Php 15000 X 12 261 if working Mondays to Fridays.

On this video understand how you are being taxed as an employee. Category My PayrollHero Account Payroll Philippine Payroll Regulations and Information. Basic Monthly Salary x 12 Total Working Days in a Year DAILY RATE.

Tax Calculator Philippines Description of Calculator. Subtract your total deductions to your monthly salary the result will be your taxable income. This will calculate the semi-monthly withholding tax as well as the take home pay.

He worked from 1980 to 2012. This tax calculator will provide a simplified computation of your monthly tax obligation under the new tax reform. Php 57508 Php 15000 X 12 313 if working Mondays to Saturdays.

Collection from Fees and Charges CYs 2000 - 2015. The most typical earning is 335513 PHP. Sa pamamagitan ng TRAIN ang bawat Pilipino ay maga-ambag sa pagpondo ng mas maraming imprastraktura at mga serbisyong panlipunan para mawala ang matinding kahirapan at mabawasan.

Just two simple steps to calculate your salary after tax in Philippines with detailed income tax calculations. Salaries can vary drastically among different job positions. Comparative Collection from Fees and Charges from National Government Agencies Highest to.

The total working days in a year TWD may vary from one employee to another. The contribution is still set at 3 following the announcement made by PhilHealth. My Salary is the same for the whole year.

Between the 2 results 13740 is higher than 6400 so his pension is 13740 pesos. All data are based on 3087 salary surveys. Top 20 Collecting Agencies and their Collections 2000 - 2015.

Base on our sample computation if you are earning 25000month your taxable income would be 23400. Taxable Income Monthly Salary - Total Deductions 25000 - 1600 23400. Heres how to compute the employees daily rate.

When you look at you payslip have you ever asked how the tax was computed. Daily Rate Monthly Rate X 12 Total working days in a year. So if the monthly rate is P1500000 and the average of working days per month is set as 24 the hourly rate may be calculated as P1500000 24 8 P7812 Based on of working days per year In this method the company will establish the average of working days per year.

The salary range for people working in Philippines in Top Management is typically from 950800 PHP minimum salary to 5084000 PHP highest average actual maximum salary is higher. 040 x 16000 pesos 6400 pesos. Tax Calculator Ang Tax Reform for Acceleration and Inclusion TRAIN ay naghahangad na baguhin ang kasalukuyang sistema ng pagbubuwis upang gawin itong simple makatarungan at mas mabisa.

This PhilHealth Contribution Calculator is a free online tool you can use to easily compute your monthly contribution to PhilHeath. First Week Second Week Third Week Fourth Week. For monthly-paid employees here is how it is computed.

If an employee regularly works from Mondays to Saturdays his expected TWD in a year is 313 days. We are using the latest PhilHeath Contribution Table 2021 to derive the right result for you. Majority of the waged workers who are earning 21000 a month or less will be exempted from tax liabilities while those who are earning more are subject to a drastically lesser tax liability than in the current tax rule.

Average salary in Philippines is 856997 PHP per year. Top National Government Agencies Collecting Fees and Charges CY 2017. This is the total monthly salary including bonuses.

Salaries in Philippines range from 11300 PHP per month minimum salary to 199000 PHP per month maximum average salary actual maximum is higher. January February March April May June July August September October November December. Need more from the Philippines Tax Calculator.

If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the Philippines tax calculator and change the Employment Income and Employment Expenses period. This is the amount of salary you are paid. Formula to compute the employees daily rate Monthly Salary 12 Day Factor Daily rate must be higher than the minimum daily wage.

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Employment Contract Sample Free Free Printable Documents Contract Template Contract Agreement Employment

Dole Guidelines For 13th Month Pay In Private Sectors

Latest 2014 2015 Sss Contribution Table For Employers And Employees Employment Contribution Sss

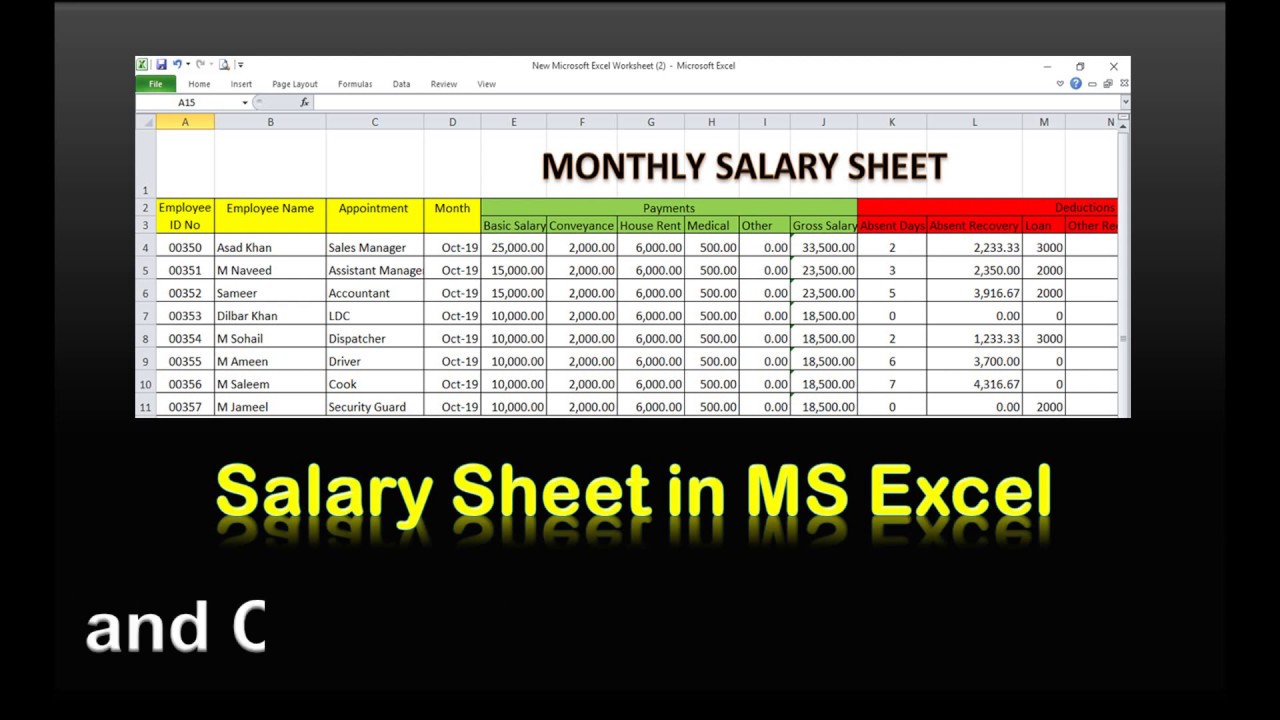

Employees Daily And Monthly Salary Calculation With Overtime In Excel By Learning Centers Excel Tutorials Salary

Download Salary Sheet With Attendance Register In Single Excel Template Exceldatapro Attendance Register Salary Budget Spreadsheet Template

Annual Income Learn How To Calculate Total Annual Income

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

How To Make Monthly Salary Sheet In Ms Excel Payroll In Ms Excel Youtube

Savings Factors To Help You On Your Journey To Retirement By Age 30 Have 1x Your Salary Age 50 4x And Age Saving For Retirement Retirement Budgeting Money

Tax Calculator Philippines 2021

Rowena Abella Iglesia Having Difficulty Calculating Your 13th Month Pay In The Philippines Here Is An Easy Guide To Help You With Examples Christmas Is Coming It S A Wonderful Time Where

Table Take Home Pay Under 2018 Tax Reform Law

Tax Calculator Compute Your New Income Tax

How Much Sss Pension Will You Receive Based On Your Current Contribution News Pensions Retirement Pension Contribution

Employment Contract Sample Free Free Printable Documents Contract Template Contract Agreement Employment

Calculating Gross Pay Worksheet Home Amortization Spreadsheet Watchi This Before You Apply Your First Va Loan Student Loan Repayment Spreadsheet Worksheets

Post a Comment for "Monthly Salary Calculator Philippines"