Total Annual Income Calculator Uk

Annual Salary PDHWBO. An accurate breakdown of your pay is provided by incorporating the calculations for the following common pay allowances and deductions.

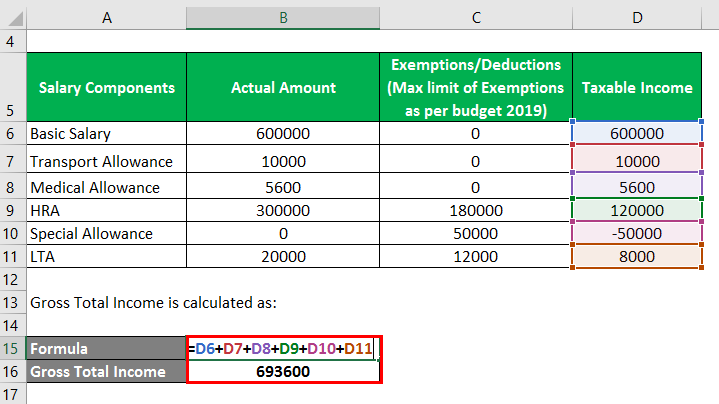

How To Calculate Income Tax In Excel

To convert to annual income.

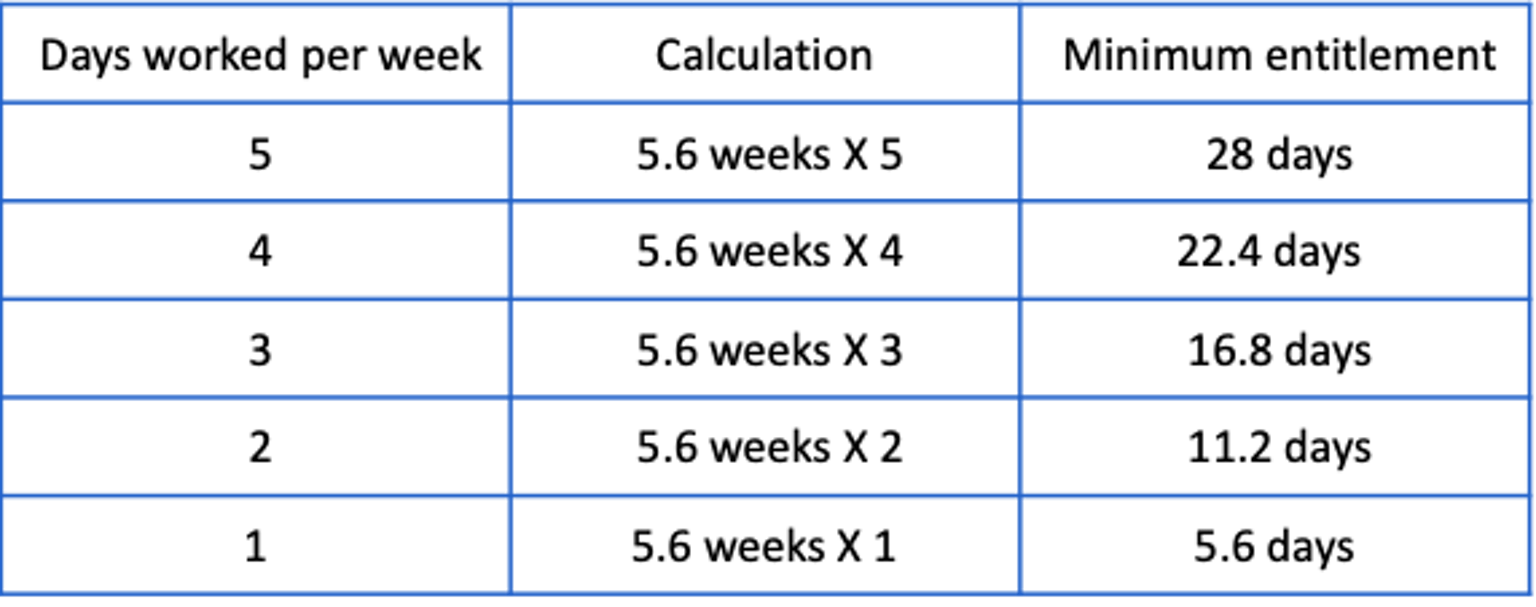

Total annual income calculator uk. Now lets see more details about how weve gotten this monthly take-home sum of 2570 after extracting your tax and NI from your yearly 40000 earnings. D is the number of days worked per week. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

To use the tax calculator enter your annual salary or the one you would like in the salary box above. One of a suite of free online calculators provided by the team at iCalculator. Updated with the platest UK personal income tax rates and thresholds for 2021.

An easy to use yet advanced salary calculator at your fingertips. Half of the population earns less than this figure and. Estimate your Income Tax for the current year.

If you work hourly youd take the hourly rate you make and multiply it by the amount of hours you work per week. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022. Income Tax Calculator is quick and easy to use.

That would be your total annual income. Our salary calculator will provide you with an illustration of the costs associated with each employee. Hourly rates weekly pay and bonuses are also catered for.

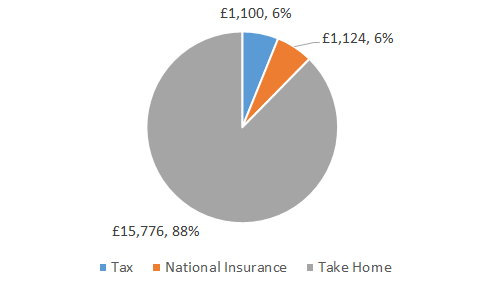

You will pay a total of 5500 in tax per year or 458 per month. Just enter your salary into our UK tax calculator. Why not find your dream salary too.

You will see the costs to you as an employer including tax NI and pension contributions. The Annual tax calculator is a comprehensive calculator for salary income tax dividends overtime pay rise and payroll calculations online. How to use our Tax Calculator To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate button.

This equates to an annual salary of 29900 annually although it should be noted that this figure represents the income of a household not an individual. Find out your take-home pay - MSE. UK income tax calculator shows your take home pay and PAYE owed to HMRC.

If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. Our UK tax calculator checks the tax you pay your net wage. We offer you the chance to provide a gross or net salary for your calculations.

View and print reportsYou can choose to print off a summary of this calculator or alternatively you can print off detailed calculation reports for your records. H is the number of hours worked per day. Follow these simple steps to calculate your salary after tax in United Kingdom or simply use the the United Kingdom Salary Calculator 2021 which is updated with the 202122 tax tables.

Calculate or estimate your total annual income. The median monthly household income in the United Kingdom is 2491 before deductions such as income tax and National Insurance payments have been made. We strongly recommend you agree to a gross salary.

You can also optionally enter a second gross salary to compare against the first. Where BO is bonuses or overtime. This is very useful is you are wondering what the difference a pay rise will make - or comparing salaries from two jobs.

Total allowance remaining for 202122. Between 50271 and 150000 youll pay at 40 known as the higher rate and above 150000 youll pay 45 the additional rate. Calculate your taxable income after relevent deductions.

Note that your personal allowance decreases by. The latest budget information from April 2021 is used to show you exactly what you need to know. On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate.

How to use the Take-Home Calculator. Where P is your hourly pay rate. The first four fields serve as a gross annual income calculator.

So lets say you accepted a job offer and your manager says the position has a salary of 55000. Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more. Just enter your salary.

If you have benefits in kind you can enter two different BIK value sot compare the differences too. W is the number of weeks worked per year. See how we can help improve your knowledge of Math Physics Tax Engineering.

This UK Tax Calculator will make light work of calculating the amount of take home pay you should have after all income tax deductions have been considered. Enter the number of hours and the rate at which you will get. You can easily convert your hourly daily weekly or monthly income to an annual figure by using some simple formulas shown below.

The result in the fourth field will be your gross annual income. To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator. The following calculator can be used to calculate your hourly to salary rate.

What is the Average UK Income. Find out the benefit of that overtime. How to Calculate Your Total Annual Income.

If youre a salaried employee total annual income would mean your annual salary. If you earn 40000 in a year you will take home 30840 leaving you with a net income of 2570 every month.

4 Ways To Calculate Annual Salary Wikihow

Gross Annual Income Calculator

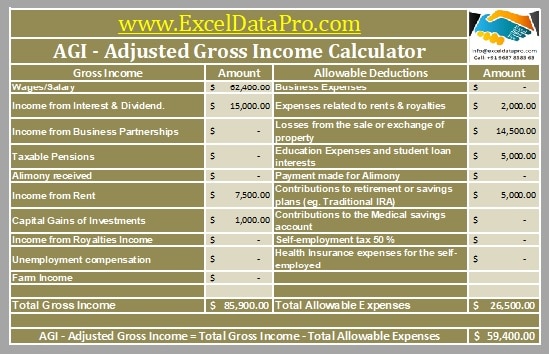

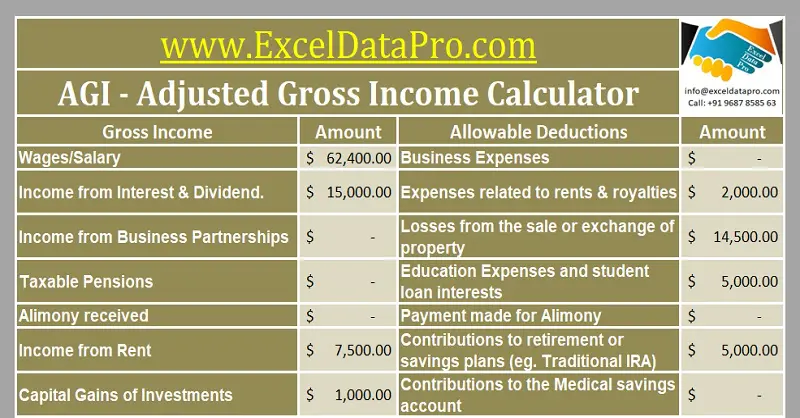

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Annual Income Learn How To Calculate Total Annual Income

Comparison Of Uk And Usa Take Home The Salary Calculator

Base Salary Explained A Guide To Understand Your Pay Packet N26

Coding Salaries In 2019 Updating The Stack Overflow Salary Calculator Stack Overflow Blog

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Budget

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Taxable Income Formula Calculator Examples With Excel Template

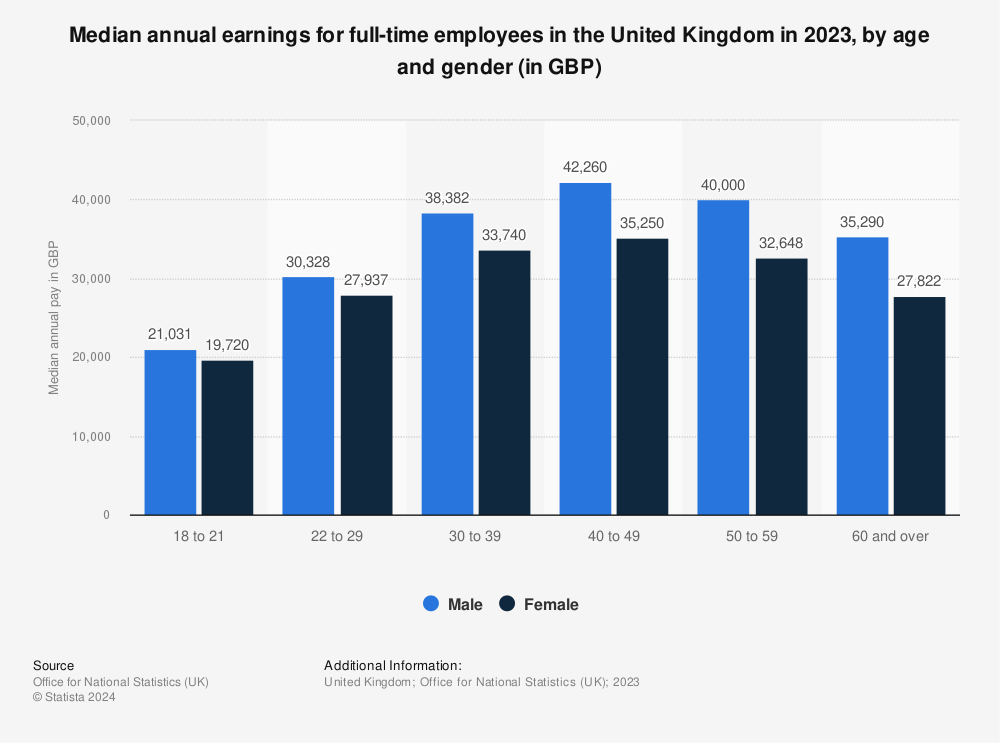

Full Time Annual Salary In The Uk 2020 By Age And Gender Statista

How To Calculate Income Tax In Excel

Comparison Of Uk And Usa Take Home The Salary Calculator

Uk Salary Tax Calculator 2021 2022 Calculate My Take Home Pay

80 000 After Tax 2021 Income Tax Uk

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Post a Comment for "Total Annual Income Calculator Uk"